ADT 2013 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

developing fair value estimates. The hierarchy gives the highest priority to quoted prices in active markets and

the lowest priority to unobservable data. In cases where two or more levels of inputs are used to determine fair

value, the level is determined based on the lowest level input that is considered significant to the fair value

measurement in its entirety. The three levels of the fair value hierarchy are summarized as follows:

• Level 1—inputs are based upon quoted prices (unadjusted) in active markets for identical assets or

liabilities which are accessible as of the measurement date.

• Level 2—inputs are based upon quoted prices for similar assets or liabilities in active markets, quoted

prices for identical or similar assets or liabilities in markets that are not active, and model derived

valuations for the asset or liability that are derived principally from or corroborated by market data for

which the primary inputs are observable, including forward interest rates, yield curves, credit risk and

exchange rates.

• Level 3—inputs for the valuations are unobservable and are based on management’s estimates of

assumptions that market participants would use in pricing the asset or liability. The fair values are

therefore determined using model based techniques such as option pricing models and discounted cash

flow models.

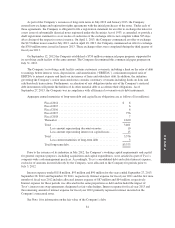

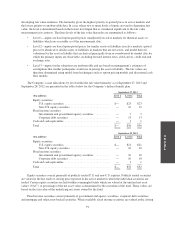

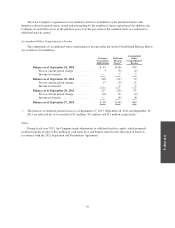

The Company’s asset allocations by level within the fair value hierarchy as of September 27, 2013 and

September 28, 2012 are presented in the tables below for the Company’s defined benefit plan.

September 27, 2013

($ in millions) Level 1 Level 2 Total

Equity securities:

U.S. equity securities ............................... $— $23 $23

Non-U.S. equity securities ........................... — 12 12

Fixed income securities:

Government and government agency securities .......... — 7 7

Corporate debt securities ............................ — 13 13

Cash and cash equivalents ............................... — 1 1

Total ................................................ $— $56 $56

September 28, 2012

($ in millions) Level 1 Level 2 Total

Equity securities:

U.S. equity securities ............................... $— $21 $21

Non-U.S. equity securities ........................... — 10 10

Fixed income securities:

Government and government agency securities .......... — 10 10

Corporate debt securities ............................ — 10 10

Cash and cash equivalents ............................... — 1 1

Total ................................................ $— $52 $52

Equity securities consist primarily of publicly traded U.S. and non-U.S. equities. Publicly traded securities

are valued at the last trade or closing price reported in the active market in which the individual securities are

traded. Certain equity securities are held within commingled funds which are valued at the unitized net asset

value (“NAV”) or percentage of the net asset value as determined by the custodian of the fund. These values are

based on the fair value of the underlying net assets owned by the fund.

Fixed income securities consist primarily of government and agency securities, corporate debt securities,

and mortgage and other asset-backed securities. When available, fixed income securities are valued at the closing

91