ADT 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Unrecognized Tax Benefits

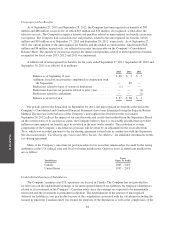

As of September 27, 2013 and September 28, 2012, the Company had unrecognized tax benefits of $87

million and $88 million, respectively, of which $69 million and $70 million, if recognized, would affect the

effective tax rate. The Company recognizes interest and penalties related to unrecognized tax benefits in income

tax expense. The Company had accrued interest and penalties related to the unrecognized tax benefits of $16

million and $10 million as of September 27, 2013 and September 28, 2012, respectively. As of September 27,

2013, the current portion of the unrecognized tax benefits and the related accrued interest, which totaled $28

million and $8 million, respectively, are reflected in income taxes payable on the Company’s Consolidated

Balance Sheet. The amount of income tax expense for interest and penalties related to unrecognized tax benefits

recognized for fiscal years 2013, 2012 and 2011 was immaterial.

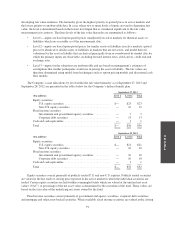

A rollforward of unrecognized tax benefits for the years ended September 27, 2013, September 28, 2012 and

September 30, 2011 is as follows ($ in millions):

2013 2012 2011

Balance as of beginning of year ............................ $ 88 $ 3 $ 5

Additions based on tax positions contributed in conjunction with

the Separation ........................................ — 85 —

Reductions related to lapse of statute of limitations ............. (1) — —

Reductions based on tax positions related to prior years ......... — — (1)

Reductions related to settlements ........................... — — (1)

Balance as of end of year ................................. $ 87 $ 88 $ 3

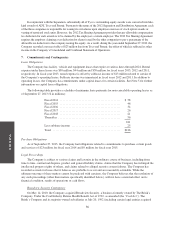

For periods prior to the Separation on September 28, 2012, the unrecognized tax benefits reflected in the

Company’s Consolidated and Combined Financial Statements have been determined using the Separate Return

Method. The increase in the balance of the Company’s unrecognized tax benefits for the year ended

September 28, 2012 reflects the impact of tax carryforwards and credits that resulted from the Separation. Based

on the current status of its income tax audits, the Company believes that it is reasonably possible that up to $40

million in unrecognized tax benefits may be resolved in the next twelve months. The resolution of certain

components of the Company’s uncertain tax positions will be offset by an adjustment to the receivable from

Tyco, which was recorded pursuant to the tax sharing agreement entered into in conjunction with the Separation.

See discussion under “Tax Sharing Agreement and Other Income Tax Matters” for additional information on this

tax sharing agreement.

Many of the Company’s uncertain tax positions relate to tax years that remain subject to audit by the taxing

authorities in the U.S. federal, state and local or foreign jurisdictions. Open tax years in significant jurisdictions

are as follows:

Jurisdiction

Years

Open To Audit

Canada ....................................... 2005 – 2013

United States ................................... 1997 – 2013

Undistributed Earnings of Subsidiaries

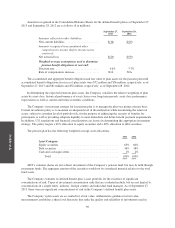

The Company’s primary non-U.S. operations are located in Canada. The Company has not provided for

income taxes on the undistributed earnings or for unrecognized deferred tax liabilities for temporary differences

related to its investment in the Company’s Canadian entity since the earnings are expected to be permanently

reinvested and the investment is permanent in duration. The determination of the amount of unrecognized

deferred tax liabilities is not practicable because of the complexities associated with the calculation including the

manner in which the Canadian entity was treated for purposes of the Separation as well as the complexities of the

84