ADT 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

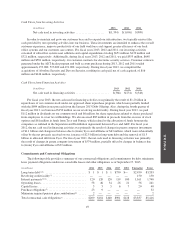

Cash Flows from Investing Activities

(in millions) 2013 2012 2011

Net cash used in investing activities .................... $(1,394) $(1,096) $(909)

In order to maintain and grow our customer base and to expand our infrastructure, we typically reinvest the

cash provided by our operating activities into our business. These investments are intended to enhance the overall

customer experience, improve productivity of our field workforce and support greater efficiency of our back

office systems and our customer care centers. For fiscal years 2013, 2012 and 2011, our investing activities

consisted of subscriber system asset additions and capital expenditures totaling $651 million, $439 million and

$321 million, respectively. Additionally, during fiscal years 2013, 2012 and 2011, we paid $555 million, $648

million and $581 million, respectively, for customer contracts for electronic security services. Customer contracts

generated under the ADT dealer program and bulk account purchases during 2013, 2012 and 2011 totaled

approximately 453,000, 527,000 and 491,000, respectively. During fiscal year 2013, we completed the

acquisitions of Absolute Security and Devcon Security, resulting in cash paid, net of cash acquired, of $16

million and $146 million, respectively.

Cash Flows from Financing Activities

(in millions) 2013 2012 2011

Net cash used in financing activities ....................... $(366) $(231) $(548)

For fiscal year 2013, the net cash used in financing activities was primarily the result of $1.2 billion in

repurchases of our common stock under our approved share repurchase program, which were partially funded

with the $694 million in net proceeds from the January 2013 Debt Offering. Also, during the fourth quarter of

fiscal year 2013, we borrowed $150 million on our revolving credit facility. During fiscal year 2013, we paid

$112 million in dividends on our common stock and $6 million for share repurchases related to shares purchased

from employees to cover tax withholdings. We also received $85 million in proceeds from the exercise of stock

options and $61 million in funds from Tyco and Pentair, which related to the allocation of funds between the

companies as outlined in the Separation and Distribution Agreement between Tyco and ADT. For fiscal year

2012, the net cash used in financing activities was primarily the result of changes in parent company investment

of $1.1 billion and changes in balances due to (from) Tyco and affiliates of $63 million, which were substantially

offset by the net proceeds received on our issuance of $2.5 billion in long-term debt and the removal of $1.5

billion in allocated debt from Tyco. For fiscal year 2011, the net cash used in financing activities was primarily

the result of changes in parent company investment of $574 million, partially offset by changes in balances due

to (from) Tyco and affiliates of $32 million.

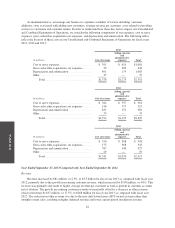

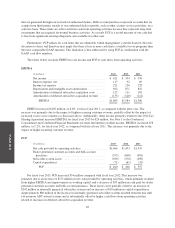

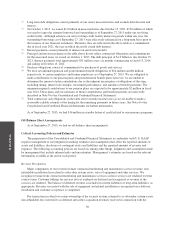

Commitments and Contractual Obligations

The following table provides a summary of our contractual obligations and commitments for debt, minimum

lease payment obligations under non-cancelable leases and other obligations as of September 27, 2013.

(in millions) 2014 2015 2016 2017 2018 Thereafter Total

Long-term debt(1)(4) ............................$1$1$1$750 $— $2,450 $3,203

Revolving credit facility(2) ....................... — — — — — 150 150

Interest payments(3)(4) ........................... 120 120 120 119 100 1,161 1,740

Operating leases ............................... 58 46 34 26 21 56 241

Capital leases .................................55567 20 48

Purchase obligations(5) .......................... 23 9 — — — — 32

Minimum required pension plan contributions(6) ..... 2 ———— — 2

Total contractual cash obligations(7) ............... $209 $181 $160 $901 $128 $3,837 $5,416

49