ADT 2013 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

in the Broadview Security acquisition) are jointly and severally liable with certain of The Brink’s Company’s

other current and former subsidiaries for health care coverage obligations provided for by the Coal Act. A

Voluntary Employees’ Beneficiary Associate (“VEBA”) trust has been established by The Brink’s Company to

pay for these liabilities, although the trust may have insufficient funds to satisfy all future obligations. At the

time of its spin-off from The Brink’s Company, Broadview Security entered into an agreement in which The

Brink’s Company agreed to indemnify it for any and all liabilities and expenses related to The Brink’s

Company’s former coal operations, including any health care coverage obligations. The Brink’s Company has

agreed that this indemnification survives the Company’s acquisition of Broadview Security. The Company has

evaluated its potential liability under the Coal Act as a contingency in light of all known facts, including the

funding of the VEBA, and indemnification provided by The Brink’s Company. The Company has concluded that

no accrual is necessary due to the existence of the indemnification and its belief that The Brink’s Company and

VEBA will be able to satisfy all future obligations under the Coal Act.

Telephone Consumer Protection Act

The Company was named as a defendant in two putative class actions that were filed on behalf of purported

classes of persons who claim to have received unsolicited “robocalls” in contravention of the U.S. Telephone

Consumer Protection Act (“TCPA”). These lawsuits were brought by plaintiffs seeking class action status and

monetary damages on behalf of all plaintiffs who allegedly received such unsolicited calls, claiming that millions

of calls were made by third party entities on the Company’s behalf. The Company asserts that such entities were

not retained by, nor authorized to make calls on behalf of, the Company. During fiscal year 2012, the Company

entered into an agreement to settle this litigation and increased its legal reserve by $15 million. On June 21, 2013,

the District Court approved the settlement and entered a Final Order of Judgment and Dismissal. Final payment

was made in the fourth fiscal quarter of 2013.

Environmental Matter

On October 25, 2013, the Company was notified by subpoena that the Office of the Attorney General of

California, in conjunction with the Alameda County District Attorney, is investigating whether certain of the

Company’s waste disposal policies, procedures and practices are in violation of the California Business and

Professions Code and the California Health and Safety Code. The Company is currently unable to predict the

outcome of this investigation or reasonably estimate a range of possible loss.

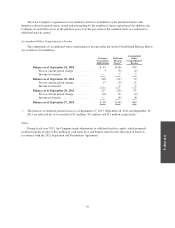

Income Tax Matters

As discussed above in Note 6, the 2012 Tax Sharing Agreement governs the rights and obligations of ADT,

Tyco and Pentair for certain pre-Separation tax liabilities. The Company is responsible for all of its own taxes

that are not shared pursuant to the 2012 Tax Sharing Agreement’s sharing formulae. Tyco and Pentair are

responsible for their tax liabilities that are not subject to the 2012 Tax Sharing Agreement’s sharing formulae.

With respect to years prior to and including the 2007 separation of Covidien and TE Connectivity by Tyco,

tax authorities have raised issues and proposed tax adjustments that are generally subject to the sharing

provisions of the 2007 Tax Sharing Agreement and which may require Tyco to make a payment to a taxing

authority, Covidien or TE Connectivity. Although Tyco has advised ADT that it has resolved a substantial

number of these adjustments, a few significant items raised by the IRS remain open with respect to the audit of

the 1997 through 2004 tax years. On July 1, 2013, Tyco announced that the IRS issued Notices of Deficiency to

Tyco primarily related to the treatment of certain intercompany debt transactions (the “Tyco IRS

Notices”). These notices assert that additional taxes of $883 million plus penalties of $154 million are owed

based on audits of the 1997 through 2000 tax years of Tyco and its subsidiaries, as they existed at that time.

Further, Tyco reported receiving Final Partnership Administrative Adjustments (the “Partnership Notices”) for

certain U.S. partnerships owned by its former U.S. subsidiaries, for which Tyco estimates an additional tax

deficiency of approximately $30 million will be asserted. The additional tax assessments related to the Tyco IRS

87