ADT 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

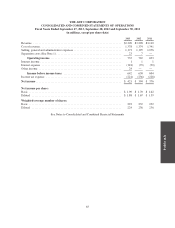

the Company was allocated $52 million and $67 million, respectively, of general corporate expenses incurred by

Tyco which are included within selling, general and administrative expenses in the Consolidated and Combined

Statements of Operations. The allocation of interest expense from Tyco was based on an assessment of the

Company’s share of Tyco’s external debt using historical data. During fiscal years 2012 and 2011, the Company

was allocated $64 million and $87 million, respectively, of interest expense incurred by Tyco. See Note 5 for

information on interest expense.

The Company has a 52- or 53-week fiscal year that ends on the last Friday in September. Both fiscal year

2013 and fiscal year 2012 were 52 -week years. Fiscal year 2011 was a 53 -week year.

The Company conducts business in one operating segment, which is identified by the Company based on

how resources are allocated and operating decisions are made. Management evaluates performance and allocates

resources based on the Company as a whole.

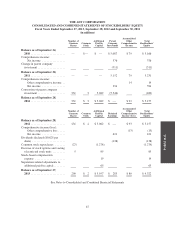

The Company conducts business through its operating entities. All intercompany transactions have been

eliminated. The results of companies acquired during the year are included in the Consolidated and Combined

Financial Statements from the effective date of acquisition.

Use of Estimates—The preparation of the Consolidated and Combined Financial Statements in conformity

with GAAP requires management to make estimates and assumptions that affect the reported amount of assets

and liabilities, disclosure of contingent assets and liabilities and reported amounts of revenue and expenses.

Significant estimates in these Consolidated and Combined Financial Statements include, but are not limited to,

estimates of future cash flows and valuation related assumptions associated with asset impairment testing, useful

lives and methods for depreciation and amortization, loss contingencies, income taxes and tax valuation

allowances and purchase price allocation. Actual results could differ materially from these estimates.

Revenue Recognition—Major components of revenue for the Company include contractual monitoring and

maintenance service revenue, non-refundable installation fees related to subscriber system assets, sales of

equipment and other services. Revenue from contractual monitoring and maintenance services is recognized as

those services are rendered over the contract term. Customer billings for services not yet rendered are deferred

and recognized as revenue as the services are rendered. The balance of deferred revenue is included in current

liabilities or long-term liabilities, as appropriate. Revenue associated with the sale of equipment and related

installation is recognized once delivery, installation and customer acceptance is completed.

For transactions in which the Company retains ownership of the security system, referred to as subscriber

system assets, non-refundable fees (referred to as deferred subscriber acquisition revenue) received in connection

with the initiation of a monitoring contract, along with associated direct and incremental selling costs (referred to

as deferred subscriber acquisition costs), are deferred and amortized over the estimated life of the customer

relationship. In certain limited circumstances, ownership of the system is contractually transferred to the

customer, in which case each deliverable provided under the arrangement is considered a separate unit of

accounting. For contracts that have multiple elements, including equipment, installation, monitoring services and

maintenance agreements, consideration is allocated to the units of accounting based on their relative selling price,

subject to the requirement that revenue recognized is limited to the amounts already received from the customer

that are not contingent upon the delivery of monitoring and maintenance services in the future.

Early termination of the contract by the customer results in a termination charge in accordance with the

customer contract, which is recognized when collectability is reasonably assured. The amounts of contract

termination charges recognized in revenue during fiscal years 2013, 2012 and 2011 were not material.

Provisions for certain rebates, refunds and discounts to customers are accounted for as reductions in revenue

in the same period the related revenue is recorded based on sales terms, historical experience and trend analysis.

Refunds occur in limited circumstances and only after all attempts to resolve customer concerns have been

exhausted. Amounts that the Company has refunded during fiscal years 2013, 2012 and 2011 were not material.

70