ADT 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

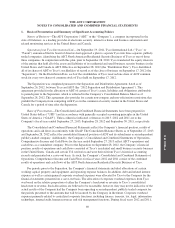

The fair value of the Company’s unsecured notes as of September 28, 2012 was determined using prices for

ADT’s securities obtained from multiple external pricing services, which is considered a Level 2 input. During

the quarter ended June 28, 2013, the Company completed exchange offers for both the $2.5 billion notes issued

in July 2012 and the $700 million notes issued in January 2013. See Note 5 for further information on the

Company’s exchange offers. The completion of these exchange offers enables the Company to use broker-quoted

market prices to determine the fair value of its debt. Therefore the fair value of the Company’s unsecured notes

as of September 27, 2013 was determined using these quoted market prices, which is considered a Level 2 input.

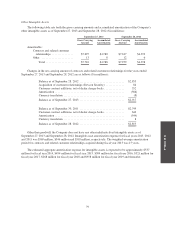

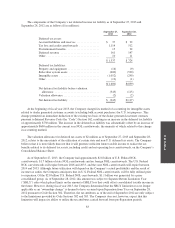

The carrying value and fair value of the Company’s debt that is subject to fair value disclosures as of

September 27, 2013 and September 28, 2012 is as follows ($ in millions):

September 27, 2013 September 28, 2012

Carrying Value Fair Value Carrying Value Fair Value

2.250% notes due July 2017 ............ $ 750 $ 716 $ 749 $ 766

3.500% notes due July 2022 ............ 998 849 998 1,038

4.125% notes due June 2023 ............ 700 618 — —

4.875% notes due July 2042 ............ 742 559 742 798

Total .............................. $3,190 $2,742 $2,489 $2,602

The carrying amount of debt outstanding under the Company’s revolving credit facility approximates fair

value as interest rates on these borrowings approximate current market rates, which is considered a Level 2 input.

Guarantees—In the normal course of business, the Company is liable for contract completion and product

performance. In the opinion of management, such obligations will not significantly affect the Company’s

financial position, results of operations or cash flows. As of September 27, 2013, the Company had $16 million

in standby letters of credit related to its insurance programs. The Company had no letters of credit as of

September 28, 2012.

Recent Accounting Pronouncements—In June 2011, the Financial Accounting Standards Board (“FASB”)

issued authoritative guidance for the presentation of comprehensive income. The guidance amended the reporting

of Other Comprehensive Income (“OCI”) by eliminating the option to present OCI as part of the statement of

stockholders’ equity. The amendment does not impact the accounting for OCI, but does impact its presentation in

the Company’s Consolidated and Combined Financial Statements. The guidance requires that items of net

income and OCI be presented either in a single continuous statement of comprehensive income or in two separate

but consecutive statements which include total net income and its components, consecutively followed by total

OCI and its components to arrive at total comprehensive income. In December 2011, the FASB issued

authoritative guidance to defer the effective date for those aspects of the guidance relating to the presentation of

reclassification adjustments out of accumulated other comprehensive income by component. The guidance

became effective for the Company in the first quarter of fiscal year 2013 and has been retrospectively applied for

the fiscal years ended September 28, 2012 and September 30, 2011. The adoption of this guidance did not have a

material impact on the Company’s financial position, results of operations or cash flows.

In September 2011, the FASB issued authoritative guidance which amends the process of testing goodwill

for impairment. The guidance permits an entity to first assess qualitative factors to determine whether the

existence of events or circumstances leads to a determination that it is more likely than not (defined as having a

likelihood of more than fifty percent) that the fair value of a reporting unit is less than its carrying amount. If an

entity determines it is not more likely than not that the fair value of a reporting unit is less than its carrying

amount, performing the traditional two-step goodwill impairment test is unnecessary. If an entity concludes

otherwise, it would be required to perform the first step of the two-step goodwill impairment test. If the carrying

amount of the reporting unit exceeds its fair value, then the entity is required to perform the second step of the

goodwill impairment test. However, an entity has the option to bypass the qualitative assessment in any period

and proceed directly to step one of the impairment test. The guidance became effective for the Company in the

first quarter of fiscal year 2013. The adoption of this guidance did not have a material impact on the Company’s

financial position, results of operations or cash flows.

76