ADT 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

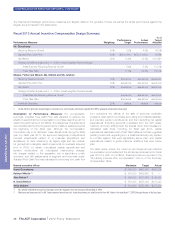

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

The Compensation Committee (and, in the case of the CEO, the

independent members of the Board of Directors) approved award

payouts for each of our NEOs, other than Ms. Mikells, in November

2013 based on the percentage of Operating Income each NEO was

eligible to receive as a maximum bonus under the Officer Short-Term

Bonus Plan, as well as through the exercise of negative discretion by

the Committee based upon the achievement of the quantitative

performance measures shown in the Fiscal 2013 Annual Incentive

Compensation Design Summary table above.

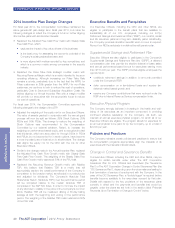

Long-Term Incentive Program

The Company’s Long-Term Incentive Program is designed to provide

a significant portion of executives’ competitive compensation

opportunity in equity based instruments. In so doing, the LTIP is a key

component in aligning the long-term interests of executives with those

of stockholders, thus promoting value creation for both our executives

and stockholders. A majority of total equity granted under the LTIP is

awarded during our annual grant process. This process occurs in

conjunction with our annual assessment of individual performance

and potential, and also takes into account a review of the competitive

compensation landscape in the LTIP award target-setting process.

To align our executives’ interests and efforts with the interests of our

stockholders, we designed the PSU metrics for fiscal year 2013 to

focus on the importance of growing the business and generating

increased cash flows by utilizing Recurring Revenue Growth and

Adjusted Free Cash Flow Growth metrics.

For fiscal year 2013, in addition to our annual LTIP awards, we

granted to certain of our key employees, including the CEO and the

other NEOs, (other than Mr. Ferber) special one-time “Founders’

Awards.” These Founders’ Awards, which were not considered part

of our regular annual compensation program, were granted in

recognition of the efforts made by key employees in connection with

our separation into a stand-alone public company, as well as to

enhance retention of the management team and further align the

interests of these key employees with those of the Company’s

stockholders. The value of the Founders’ Awards was equal to 50%

of an employee’s fiscal year 2013 annual equity award. Mr. Ferber

was not employed by the company at the time the Founders’ Awards

were granted.

Awards of equity under the annual LTIP process are delivered to

employees utilizing a mix of Stock Options, RSUs and PSUs. The

weighting of the different components of the awards varies by

employee level. The Founders’ Awards granted in fiscal year 2013

were delivered utilizing Stock Options and RSUs, and the weighting

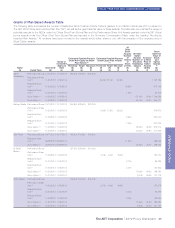

of each component was equal for all recipients. The table below

summarizes the weighting of the components of equity awards made

in fiscal year 2013 to our CEO and other NEOs:

Annual Awards Founders’ Awards

CEO 50% Stock Options

50% PSUs

50% Stock Options

50% RSUs

Other NEOs 40% Stock Options

40% PSUs

20% RSUs

50% Stock Options

50% RSUs

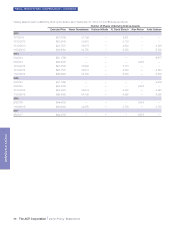

The following table describes the general terms and conditions applicable to each of the equity-based grant type:

Grant Type Vesting Other Terms & Conditions

Fiscal Year 2013

Annual Awards

Stock Options 25% per year •Granted with an exercise price equal to the

closing price of the Company’s common

stock on the date of grant.

•Expire on the 10th anniversary of the grant

unless forfeited earlier.

PSUs 100% on the 3rd anniversary of the grant date,

subject to satisfaction of performance conditions

•Vesting subject to performance against

Recurring Revenue Growth (60% weighting)

and Adjusted Free Cash Flow Growth (40%

weighting).

•Accumulate dividend equivalent units

(“DEUs”) with respect to dividends, which

vest only to the extent of vesting of the

underlying PSU award.

RSUs 25% per year •Accumulate DEUs with respect to dividends,

which vest in accordance with the vesting of

the underlying RSU award.

Founders’

Awards

Stock Options One-third per year See Fiscal Year 2013 Annual Grant above.

RSUs 100% on the 3rd anniversary of the grant date See Fiscal Year 2013 Annual Grant above.

The ADT Corporation 2014 Proxy Statement 29

PROXY STATEMENT