ADT 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

dis-synergies associated with the separation of our business from the commercial security business of Tyco. The

increases in depreciation and amortization and cost to serve expenses were partially offset by a $20 million

reduction in gross subscriber acquisition cost expenses. This reduction was driven by the deferral of a higher

proportion of upfront installation costs associated with the mix shift toward more ADT-owned systems.

Interest Expense, net

Net interest expense was $92 million for fiscal year 2012 compared with $89 million for fiscal year 2011.

Interest expense for fiscal years 2012 and 2011 include allocated interest expense related to Tyco’s external debt

of $64 million and $87 million, respectively. Also included in net interest expense for fiscal year 2012 was

approximately $22 million of interest on our unsecured notes and $3 million of financing costs incurred in

connection with a bridge facility.

Income Tax Expense

Income tax expense was $236 million for fiscal year 2012 compared with $228 million for fiscal year 2011,

while the effective tax rate fell slightly to 37.5%. The effective tax rate can vary from period to period due to

permanent tax adjustments, discrete items such as the settlement of income tax audits and changes in tax laws, as

well as recurring factors such as changes in the overall effective state tax rate.

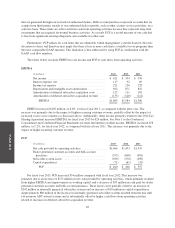

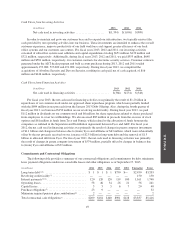

Non-GAAP Measures

To provide investors with additional information regarding our results as determined by GAAP, we also

disclose non-GAAP measures which management believes provide useful information to investors. These

measures consist of EBITDA and FCF. These measures are not financial measures calculated in accordance with

GAAP and should not be considered as substitutes for net income, operating profit, cash from operating activities

or any other operating performance measure calculated in accordance with GAAP, and they may not be

comparable to similarly titled measures reported by other companies. We use EBITDA to measure the

operational strength and performance of our business. We use FCF as an additional performance measure of our

ability to service debt, make other investments and return capital to stockholders through dividends and share

repurchases. These measures, or measures that are based on them, may also be used as components in our

incentive compensation plans.

We believe EBITDA is useful because it measures our success in acquiring, retaining and servicing our

customer base and our ability to generate and grow our recurring revenue while providing a high level of

customer service in a cost-effective manner. EBITDA excludes interest expense and the provision for income

taxes. Excluding these items eliminates the expenses associated with our capitalization and tax structure. Because

EBITDA excludes interest expense, it does not give effect to cash used for debt service requirements and thus

does not reflect available funds for distributions, reinvestment or other discretionary uses. EBITDA also excludes

depreciation and amortization, which eliminates the impact of non-cash charges related to capital investments.

Depreciation and amortization includes depreciation of subscriber system assets and other fixed assets,

amortization of deferred costs and deferred revenue associated with subscriber acquisitions and amortization of

dealer and other intangible assets.

There are material limitations to using EBITDA. EBITDA may not be comparable to similarly titled

measures reported by other companies. Furthermore, EBITDA does not take into account certain significant

items, including depreciation and amortization, interest expense and tax expense, which directly affect our net

income. These limitations are best addressed by considering the economic effects of the excluded items

independently, and by considering EBITDA in conjunction with net income as calculated in accordance with

GAAP.

FCF is defined as cash from operations less cash outlays related to capital expenditures, subscriber system

assets, dealer generated customer accounts and bulk account purchases. Dealer generated accounts are accounts

45