ADT 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

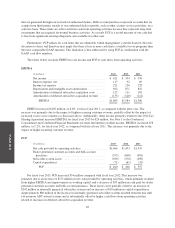

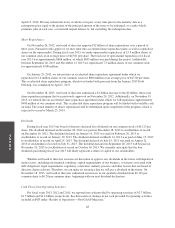

(1) Long-term debt obligations consist primarily of our senior unsecured notes and exclude debt discount and

interest.

(2) On October 1, 2013, we issued $1.0 billion in unsecured notes due October 15, 2021, $150 million of which

was used to repay the amounts borrowed and outstanding as of September 27, 2013 under our revolving

credit facility. Although advances on our revolving credit facility mature in periods within one year, the

outstanding borrowings as of September 27, 2013 were effectively refinanced on a long-term basis prior to

the issuance of our financial statements. Therefore, they are reflected in the above table as a commitment

due in fiscal year 2021, the year in which the newly issued debt matures.

(3) Interest payments consist primarily of interest on our fixed-rate debt.

(4) Principal and interest payments in the table above do not reflect contractual obligations and commitments

for the unsecured notes we issued on October 1, 2013. The debt principal of $1.0 billion is due October 15,

2021. Interest payments total approximately $31 million every six months commencing on April 15, 2014

and ending on October 15, 2021.

(5) Purchase obligations consist of commitments for purchases of goods and services.

(6) We have net unfunded pension and postretirement benefit obligations of $16 million and $6 million,

respectively, to certain employees and former employees as of September 27, 2013. We are obligated to

make contributions to our pension plans and postretirement benefit plans; however, we are unable to

determine the amount of plan contributions due to the inherent uncertainties of obligations of this type,

including timing, interest rate changes, investment performance, and amounts of benefit payments. The

minimum required contributions to our pension plans are expected to be approximately $2 million in fiscal

year 2014. These plans and our estimates of future contributions and benefit payments are more fully

described in Note 8 to the Consolidated and Combined Financial Statements.

(7) Total contractual cash obligations in the table above exclude income taxes as we are unable to make a

reasonably reliable estimate of the timing for the remaining payments in future years. See Note 6 to the

Consolidated and Combined Financial Statements for further information.

As of September 27, 2013, we had $16 million in standby letters of credit related to our insurance programs.

Off-Balance Sheet Arrangements

As of September 27, 2013, we had no off-balance sheet arrangements.

Critical Accounting Policies and Estimates

The preparation of the Consolidated and Combined Financial Statements in conformity with U.S. GAAP

requires management to use judgment in making estimates and assumptions that affect the reported amounts of

assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of revenue and

expenses. The following accounting policies are based on, among other things, judgments and assumptions made

by management that include inherent risks and uncertainties. Management’s estimates are based on the relevant

information available at the end of each period.

Revenue Recognition

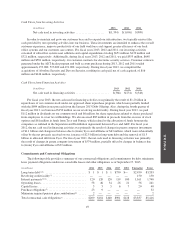

Major components of our revenue include contractual monitoring and maintenance service revenue, non-

refundable installation fees related to subscriber system assets, sales of equipment and other services. We

recognize revenue from contractual monitoring and maintenance services as those services are rendered over the

contract term. Customer billings for services not yet rendered are deferred and recognized as revenue as the

services are rendered. The balance of deferred revenue is included in current liabilities or long-term liabilities, as

appropriate. Revenue associated with the sale of equipment and related installation is recognized once delivery,

installation and customer acceptance is completed.

For transactions in which we retain ownership of the security system, referred to as subscriber system assets,

non-refundable fees (referred to as deferred subscriber acquisition revenue) received in connection with the

50