ADT 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

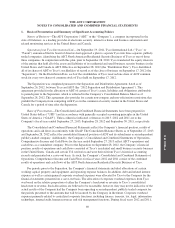

Concentration of Credit Risks—Financial instruments which potentially subject the Company to

concentrations of credit risks are principally accounts receivables. The Company’s concentration of credit risk

with respect to accounts receivable is limited due to the significant size of its customer base.

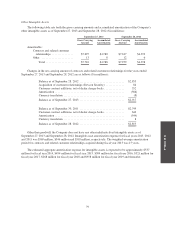

Insurable Liabilities—For fiscal years 2011 and 2012, the Company was insured for worker’s

compensation, property, product, general and auto liabilities through a captive insurance company, wholly owned

by Tyco. The captive’s policies covering these risks were deductible reimbursement policies. Tyco maintained

insurance for losses in excess of the captive insurance company policies’ limits through third party insurance

companies. The captive insurance company retained the risk of loss associated with claims incurred prior to the

Separation, and therefore, Tyco retained the liability associated with those claims. Accordingly, the Company

records receivables from Tyco to offset ADT’s liabilities related to these insurance claims. The assets and

liabilities associated with claims incurred under these insurance policies reflected in the Company’s Consolidated

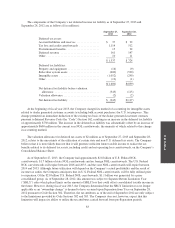

Balance Sheets as of September 27, 2013 and September 28, 2012 are as follows ($ in millions):

September 27,

2013

September 28,

2012

Prepaid expenses and other current assets ........ $11 $11

Other assets ............................... 27 36

Total assets ............................ $38 $47

Accrued and other current liabilities ............ $11 $11

Other liabilities ............................. 27 36

Total liabilities ......................... $38 $47

Following the Separation on September 28, 2012, the Company maintains its own standalone insurance

policies to manage certain of its insurable liabilities. As of September 27, 2013, the Company’s Consolidated

Balance Sheet includes liabilities related to the Company’s standalone insurance policies of approximately $31

million, of which $21 million is reflected in accrued and other current liabilities and $10 million is reflected in

other liabilities.

Financial Instruments—The Company’s financial instruments consist primarily of cash and cash

equivalents, accounts receivable, accounts payable and debt. Included in cash and cash equivalents as of

September 27, 2013 and September 28, 2012 is approximately $124 million and $187 million, respectively, of

available-for sale securities, representing cash invested in money market mutual funds. These investments are

classified as “Level 1” for purposes of fair value measurement, which is performed each reporting period. Any

unrealized holding gains or losses are excluded from earnings and reported in other comprehensive income until

realized. Due to their short-term nature, the fair value of cash and cash equivalents, including the money market

mutual funds, accounts receivable and accounts payable approximated book value as of September 27, 2013 and

September 28, 2012.

75