ADT 2013 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

price reported in the active market in which the individual security is traded. Government and agency securities

and corporate debt securities are valued using the most recent bid prices or occasionally the mean of the latest bid

and ask prices when markets are less liquid. When quotes are not available, fair value is determined utilizing a

discounted cash flow approach, which incorporates other observable inputs such as cash flows, underlying

security structure and market information including interest rates and bid evaluations of comparable securities.

Certain fixed income securities are held within commingled funds which are valued utilizing NAV determined by

the custodian of the fund. These values are based on the fair value of the underlying net assets owned by the

fund.

Cash and cash equivalents consist primarily of short-term commercial paper, bonds and other cash or cash-

like instruments including settlement proceeds due from brokers, stated at cost, which approximates fair value.

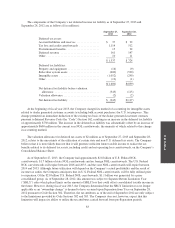

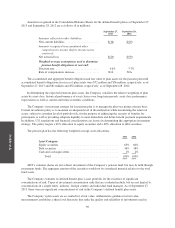

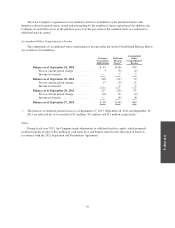

The following tables set forth a summary of pension plan assets valued using NAV or its equivalent as of

September 27, 2013 and September 28, 2012 ($ in millions):

September 27, 2013

Investment

Fair

Value

Redemption

Frequency Redemption Notice Period

U.S. equity securities .................. $23 Daily 1 day, 5 days

Non-U.S. equity securities .............. 12 Daily 2 days

Government and government agency

securities .......................... 7 Daily 2 days

Corporate debt securities ............... 13 Daily 2 days

$55

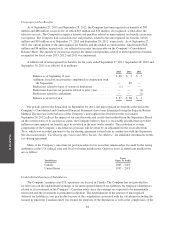

September 28, 2012

Investment

Fair

Value

Redemption

Frequency Redemption Notice Period

U.S. equity securities .................. $21 Daily 1 day, 5 days

Non-U.S. equity securities .............. 10 Daily 3 days

Government and government agency

securities .......................... 10 Daily 2 days

Corporate debt securities ............... 10 Daily 2 days

$51

The strategy of the Company’s investment managers with regard to the investments valued using NAV or its

equivalent is to either match or exceed relevant benchmarks associated with the respective asset category. None

of the investments valued using NAV or its equivalent contain any redemption restrictions or unfunded

commitments.

The Company’s funding policy is to make contributions in accordance with U.S. laws as well as to make

discretionary voluntary contributions from time-to-time. During fiscal year 2013, the Company contributed $2

million to its pension plan, which represented the Company’s minimum required contributions to its pension plan

for that period. The Company anticipates that it will contribute at least the minimum required to its pension plan

in fiscal year 2014 of $2 million.

92