ADT 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

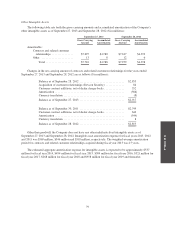

6. Income Taxes

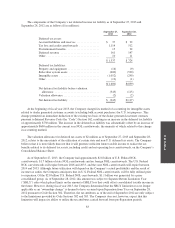

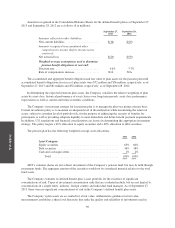

Significant components of income before income taxes for fiscal years 2013, 2012 and 2011 are as follows

($ in millions):

2013 2012 2011

United States ........................................... $610 $581 $543

Non-U.S. .............................................. 32 49 61

$642 $630 $604

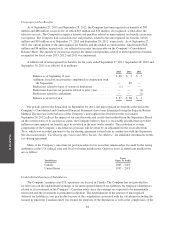

Significant components of the income tax provision for fiscal years 2013, 2012 and 2011 are as follows ($ in

millions):

2013 2012 2011

Current:

United States:

Federal ........................................ $ 7 $170 $228

State .......................................... 1 36 33

Non-U.S. .......................................... 6 8 20

Current income tax provision .......................... $ 14 $214 $281

Deferred:

United States:

Federal ........................................ $172 $ 21 $ (50)

State .......................................... 33 (6) —

Non-U.S. .......................................... 2 7 (3)

Deferred income tax provision ......................... 207 22 (53)

$221 $236 $228

The decrease in the current income tax provision in fiscal year 2013 is primarily due to the net operating

loss (“NOL”) carryforward generated during the year. See discussion below for additional information on the

Company’s NOL carryforwards.

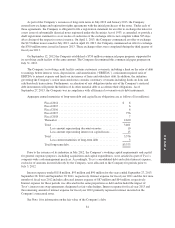

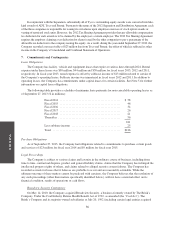

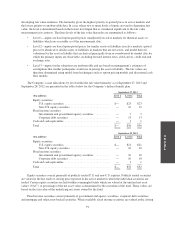

The reconciliation between the actual effective tax rate on continuing operations and the statutory U.S.

federal income tax rate for fiscal years 2013, 2012 and 2011 is as follows:

2013 2012 2011

Federal statutory tax rate ................................. 35.0% 35.0% 35.0%

Increases (reductions) in taxes due to:

U.S. state income tax provision, net ..................... 3.5% 3.4% 3.5%

Non-U.S. net earnings ............................... (0.5)% (0.6)% (0.7)%

Trademark amortization .............................. (3.6)% — % — %

Nondeductible charges ............................... (1.0)% — % 0.2%

Other ............................................. 1.0% (0.3)% (0.3)%

Provision for income taxes ................................ 34.4% 37.5% 37.7%

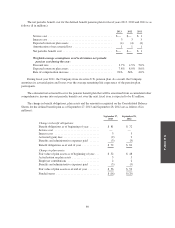

Deferred income taxes result from temporary differences between the amount of assets and liabilities

recognized for financial reporting and tax purposes.

82