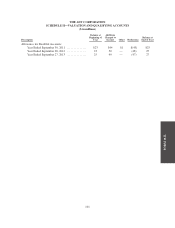

ADT 2013 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

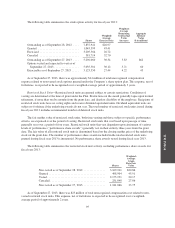

(1) Long-lived assets are comprised primarily of subscriber system assets, net; property and equipment, net;

deferred subscriber acquisition costs, net; and dealer intangibles, net and exclude goodwill, other intangible

assets and other assets.

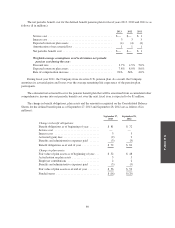

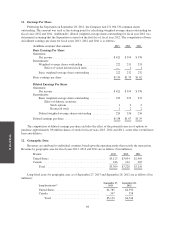

13. Quarterly Financial Data (Unaudited)

Summarized quarterly financial data for fiscal years 2013 and 2012 is as follows ($ in millions, except per

share data):

2013

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Revenue ......................................... $809 $821 $833 $846

Gross profit ....................................... 473 480 490 488

Net income ....................................... 105 107 113 96

Net income per share:

Basic ........................................ $0.45 $0.47 $0.52 $0.45

Diluted ...................................... $0.44 $0.47 $0.52 $0.45

2012

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Revenue ......................................... $795 $807 $814 $812

Gross profit ....................................... 450 458 470 476

Net income ....................................... 93 105 102 94

Net income per share(1):

Basic ........................................ $0.40 $0.45 $0.44 $0.41

Diluted ...................................... $0.39 $0.44 $0.43 $0.40

(1) The Separation was completed on September 28, 2012, and the Company issued 231 million shares of

common stock. This initial share amount has been used to calculate earnings per share for all periods

presented for fiscal year 2012. See Note 11 for additional information on earnings per share.

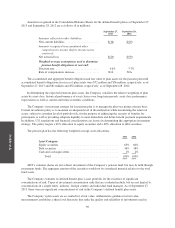

14. Subsequent Events

Share Repurchase Program

Between September 28, 2013 and November 13, 2013, the Company repurchased 7.3 million shares of its

common stock for approximately $300 million.

On November 18, 2013, the Company’s board of directors authorized a $1 billion increase to the $2 billion,

three-year share repurchase program that was previously approved on November 26, 2012. Additionally, on

November 19, 2013, the Company entered into an accelerated share repurchase agreement under which it will

repurchase approximately $400 million of ADT’s common stock. This accelerated share repurchase program will

be funded with available cash on hand. The actual number of shares repurchased will be determined upon

completion of the program, which is expected to occur by March 25, 2014.

Debt

On October 1, 2013, the Company issued $1.0 billion aggregate principal amount of 6.250% unsecured

notes due October 2021 to certain institutional investors pursuant to certain exemptions from registration under

the Securities Act of 1933, as amended. Net cash proceeds from the issuance of this term indebtedness totaled

$987 million, of which $150 million was used to repay the outstanding borrowings under the Company’s

99