ADT 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

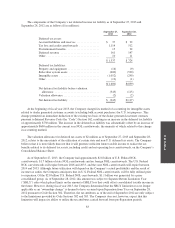

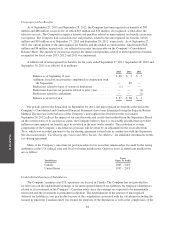

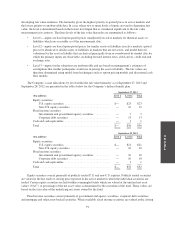

The components of the Company’s net deferred income tax liability as of September 27, 2013 and

September 28, 2012 are as follows ($ in millions):

September 27,

2013

September 28,

2012

Deferred tax assets:

Accrued liabilities and reserves ................ $ 37 $ 32

Tax loss and credit carryforwards .............. 1,114 512

Postretirement benefits ....................... 15 22

Deferred revenue ........................... 161 147

Other ..................................... 10 11

$ 1,337 $ 724

Deferred tax liabilities:

Property and equipment ...................... (16) (9)

Subscriber system assets ..................... (600) (530)

Intangible assets ............................ (1,052) (299)

Other ..................................... (12) (1)

$(1,680) $(839)

Net deferred tax liability before valuation

allowance ............................... (343) (115)

Valuation allowance ......................... (2) (2)

Net deferred tax liability ..................... $ (345) $(117)

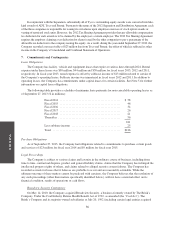

At the beginning of fiscal year 2013, the Company changed its method of accounting for intangible assets

related to dealer generated customer accounts (excluding bulk account purchases) for U.S. tax purposes. This

change permitted an immediate deduction of the existing tax basis of the dealer generated customer contracts

pursuant to Internal Revenue Code (the “Code”) Section 162, resulting in an increase in the deferred tax liability

of approximately $730 million. The increase in the deferred tax liability was substantially offset by an increase of

approximately $600 million in the current year NOL carryforwards, the majority of which related to this change

in accounting method.

The valuation allowance for deferred tax assets of $2 million as of September 27, 2013 and September 28,

2012, relates to the uncertainty of the utilization of certain state and non-U.S. deferred tax assets. The Company

believes that it is more likely than not that it will generate sufficient future taxable income to realize the tax

benefits related to its deferred tax assets, including credit and net operating loss carryforwards, on the Company’s

Consolidated Balance Sheet.

As of September 27, 2013, the Company had approximately $2.8 billion of U.S. Federal NOL

carryforwards, $1.7 billion of state NOL carryforwards and no foreign NOL carryforwards. The U.S. Federal

NOL carryforwards will expire between 2016 and 2033, and the state NOL carryforwards will expire between

2014 and 2033. Although future utilization will depend on the Company’s actual profitability and the result of

income tax audits, the Company anticipates that its U.S. Federal NOL carryforwards, will be fully utilized prior

to expiration. Of the $2.8 billion U.S. Federal NOL carryforwards, $1.1 billion was generated by a prior

consolidated group. As of September 28, 2012, this amount was subject to Separate Return Limitation Year

(“SRLY”) rules which placed limits on the amount of SRLY loss that could offset consolidated taxable income in

the future. However, during fiscal year 2013, the Company determined that the SRLY limitation was no longer

applicable as an “ownership change” is deemed to have occurred upon Separation from Tyco on September 28,

2012 pursuant to Code Section 382. Therefore, the tax attributes as of the end of September 2012 are only subject

to the limitations provided by Code Sections 382 and 383. The Company does not, however, expect that this

limitation will impact its ability to utilize the tax attributes carried forward from pre-Separation periods.

83