ADT 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

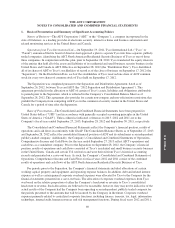

In July 2012, the FASB issued authoritative guidance which amends the process of testing indefinite-lived

intangible assets for impairment. This guidance permits an entity to first assess qualitative factors to determine

whether the existence of events or circumstances leads to a determination that it is more likely than not (defined

as having a likelihood of more than fifty percent) that the indefinite-lived intangible asset is impaired. If an entity

determines it is not more likely than not that the indefinite-lived intangible asset is impaired, the entity will have

an option not to calculate the fair value of an indefinite-lived asset annually. The guidance became effective for

the Company in the first quarter of fiscal year 2013. The adoption of this guidance did not have a material impact

on the Company’s financial position, results of operations or cash flows.

In February 2013, the FASB issued authoritative guidance which expands the disclosure requirements for

amounts reclassified out of accumulated other comprehensive income (“AOCI”). The guidance requires an entity

to provide information about the amounts reclassified out of AOCI by component and present, either on the face

of the income statement or in the notes to financial statements, significant amounts reclassified out of AOCI by

the respective line items of net income but only if the amount reclassified is required under GAAP to be

reclassified to net income in its entirety in the same reporting period. For other amounts, an entity is required to

cross-reference to other disclosures required under GAAP that provide additional detail about those amounts.

This guidance does not change the current requirements for reporting net income or OCI in financial statements.

The guidance is effective for the Company in the first quarter of fiscal year 2014. The adoption of this guidance

is not expected to have a material impact on the Company’s financial position, results of operations or cash

flows.

In July 2013, the FASB issued authoritative guidance which amends the guidance related to the presentation

of unrecognized tax benefits and allows for the reduction of a deferred tax asset for a net operating loss

carryforward whenever the net operating loss carryforward or tax credit carryforward would be available to

reduce the additional taxable income or tax due if the tax position is disallowed. This guidance is effective for

annual and interim periods for fiscal years beginning after December 15, 2013, and early adoption is permitted.

The adoption of this guidance is not expected to have a material impact on the Company’s financial position,

results of operations or cash flows.

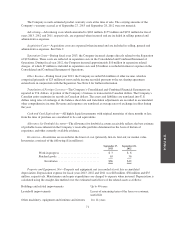

2. Acquisitions

Dealer Generated Customer Accounts and Bulk Account Purchases

During fiscal years 2013, 2012 and 2011, the Company paid $555 million, $648 million and $581 million,

respectively, for customer contracts for electronic security services. Customer contracts generated under the ADT

dealer program and bulk account purchases during fiscal years 2013, 2012 and 2011 totaled approximately

453,000, 527,000 and 491,000, respectively.

Acquisitions

On October 1, 2012, the Company completed the acquisition of Absolute Security, which had been an ADT

authorized dealer, with $16 million of cash paid during fiscal year 2013. As part of this acquisition, the Company

recognized $20 million of goodwill. On August 2, 2013, the Company acquired all of the issued and outstanding

capital stock of Devcon Security Holdings, Inc. (“Devcon Security”) for cash consideration of $146 million, net

of cash acquired. Devcon Security provides alarm monitoring services and related equipment to residential

homes, businesses and homeowners associations in the United States. As part of this acquisition, the Company

recognized intangible assets of $84 million in customer relationships and $60 million of goodwill as well as

insignificant amounts of net working capital and tangible assets. The amounts of revenues and earnings for

Devcon Security included in the Company’s results of operation for the two months ended September 27, 2013

were immaterial. The purchase price allocation for the Devcon Security acquisition is preliminary and remains

subject to post-closing adjustments.

These acquisitions were not material to the Company’s financial statements. There were no acquisitions

made by the Company during fiscal years 2012 and 2011.

77