ADT 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

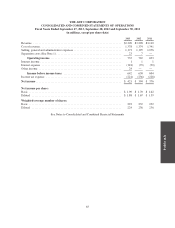

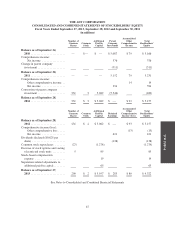

THE ADT CORPORATION

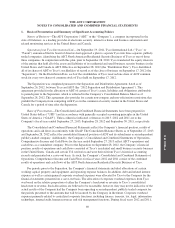

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies

Nature of Business—The ADT Corporation (“ADT” or the “Company”), a company incorporated in the

state of Delaware, is a leading provider of electronic security, interactive home and business automation and

related monitoring services in the United States and Canada.

Separation from Tyco International Ltd.—On September 19, 2011, Tyco International Ltd. (“Tyco” or

“Parent”) announced that its board of directors had approved a plan to separate Tyco into three separate, publicly

traded companies, identifying the ADT North American Residential Security Business of Tyco as one of those

three companies. In conjunction with this plan, prior to September 28, 2012, Tyco transferred the equity interests

of the entities that held all of the assets and liabilities of its residential and small business security business in the

United States and Canada to ADT. Effective on September 28, 2012 (the “Distribution Date”), Tyco distributed

all of its shares of ADT to Tyco’s stockholders of record as of the close of business on September 17, 2012 (the

“Separation”). On the Distribution Date, each of the stockholders of Tyco received one share of ADT common

stock for every two shares of common stock of Tyco held on September 17, 2012.

The Separation was completed pursuant to the Separation and Distribution Agreement, dated as of

September 26, 2012, between Tyco and ADT (the “2012 Separation and Distribution Agreement”). This

agreement provided for the allocation to ADT of certain of Tyco’s assets, liabilities and obligations attributable

to periods prior to the Separation, which is reflected in the Company’s Consolidated Balance Sheet as of

September 28, 2012. This agreement also provides for certain non-compete and non-solicitation restrictions that

prohibit the Company from competing with Tyco in the commercial security market in the United States and

Canada for a period of time after the Separation.

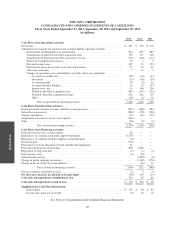

Basis of Presentation—The Consolidated and Combined Financial Statements have been prepared in

United States dollars (“USD”) and in accordance with generally accepted accounting principles in the United

States of America (“GAAP”). Unless otherwise indicated, references to 2013, 2012 and 2011 are to the

Company’s fiscal years ended September 27, 2013, September 28, 2012 and September 30, 2011, respectively.

The Consolidated and Combined Financial Statements reflect the Company’s financial position, results of

operations and cash flows in conformity with GAAP. The Consolidated Balance Sheets as of September 27, 2013

and September 28, 2012 reflect the consolidated financial position of ADT and its subsidiaries as an independent

publicly-traded company. Additionally, the Company’s Consolidated and Combined Statements of Operations,

Comprehensive Income and Cash Flows for the year ended September 27, 2013 reflect ADT’s operations and

cash flows as a standalone company. Prior to the Separation on September 28, 2012, the Company’s financial

position, results of operations and cash flows consisted of Tyco’s residential and small business security business

in the United States, Canada and certain U.S. territories and were derived from Tyco’s historical accounting

records and presented on a carve-out basis. As such, the Company’s Consolidated and Combined Statements of

Operations, Comprehensive Income and Cash Flows for fiscal years 2012 and 2011 consist of the combined

results of operations and cash flows of the ADT North American Residential Security Business of Tyco.

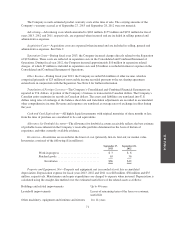

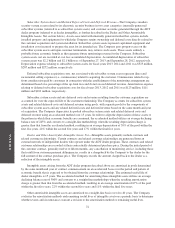

For periods prior to the Separation, the Company’s financial statements included allocations of certain

working capital, property and equipment, and operating expense balances. In addition, debt and related interest

expense as well as certain general corporate overhead expenses were allocated by Tyco to the Company for the

financial statements presented on a carve-out basis. The allocation of corporate overhead expenses from Tyco

was based on the relative proportion of either the Company’s headcount or revenue to Tyco’s consolidated

headcount or revenue. Such allocations are believed to be reasonable; however, they may not be indicative of the

actual results of the Company had the Company been operating as an independent, publicly traded company for

the periods presented or the amounts that will be incurred by the Company in the future. Corporate overhead

expenses primarily related to centralized corporate functions, including finance, treasury, tax, legal, information

technology, internal audit, human resources and risk management functions. During fiscal years 2012 and 2011,

69