ADT 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

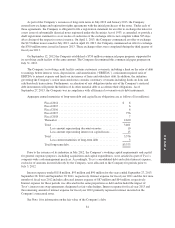

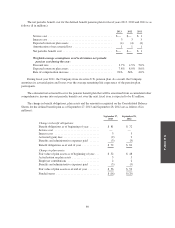

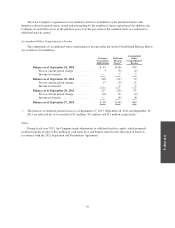

Amounts recognized in the Consolidated Balance Sheets for the defined benefit plan as of September 27,

2013 and September 28, 2012 are as follows ($ in millions):

September 27,

2013

September 28,

2012

Amounts reflected in other liabilities:

Non-current liabilities ....................... $(16) $(29)

Amounts recognized in accumulated other

comprehensive income (before income taxes)

consist of:

Net actuarial loss ........................... $(29) $(39)

Weighted-average assumptions used to determine

pension benefit obligations at year end:

Discount rate .............................. 4.6% 3.7%

Rate of compensation increase ................. N/A N/A

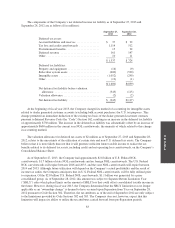

The accumulated and aggregate benefit obligation and fair value of plan assets for the pension plan with

accumulated benefit obligations in excess of plan assets were $72 million and $56 million, respectively, as of

September 27, 2013 and $81 million and $52 million, respectively, as of September 28, 2012.

In determining the expected return on plan assets, the Company considers the relative weighting of plan

assets by asset class, historical performance of asset classes over long-term periods, asset class performance

expectations as well as current and future economic conditions.

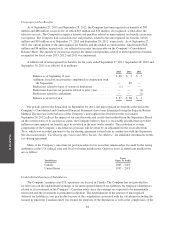

The Company’s investment strategy for its pension plan is to manage the plan on a going-concern basis.

Current investment policy is to maintain an adequate level of diversification while maximizing the return on

assets, subject to a prudent level of portfolio risk, for the purpose of enhancing the security of benefits for

participants as well as providing adequate liquidity to meet immediate and future benefit payment requirements.

In addition, U.S. regulations and financial considerations are factors in determining the appropriate investment

strategy. The policy targets a 60% allocation to equity securities and a 40% allocation to debt securities.

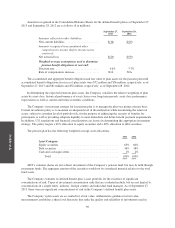

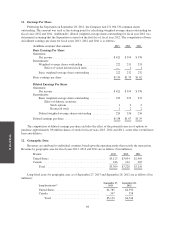

The pension plan has the following weighted-average asset allocations:

2013 2012

Asset Category:

Equity securities ......................................... 63% 60%

Debt securities .......................................... 36% 38%

Cash and cash equivalents ................................. 1% 2%

Total .............................................. 100% 100%

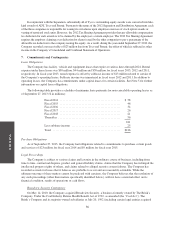

ADT’s common shares are not a direct investment of the Company’s pension fund, but may be held through

investment funds. The aggregate amount of the securities would not be considered material relative to the total

fund assets.

The Company evaluates its defined benefit plan’s asset portfolio for the existence of significant

concentrations of risk. Types of investment concentration risks that are evaluated include, but are not limited to,

concentrations in a single entity, industry, foreign country and individual fund manager. As of September 27,

2013, there were no significant concentrations of risk in the Company’s defined benefit plan assets.

The Company’s plan assets are accounted for at fair value. Authoritative guidance for fair value

measurements establishes a three level hierarchy that ranks the quality and reliability of information used in

90