ADT 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

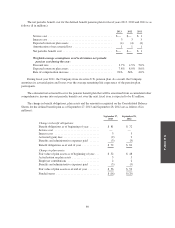

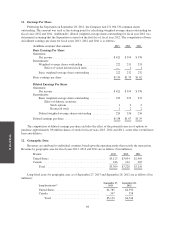

11. Earnings Per Share

Following the Separation on September 28, 2012, the Company had 231,094,332 common shares

outstanding. This amount was used as the starting point for calculating weighted-average shares outstanding for

fiscal years 2012 and 2011. Additionally, diluted weighted-average shares outstanding for fiscal year 2012 was

determined assuming that the Separation occurred on the first day of fiscal year 2012. The computation of basic

and diluted earnings per share for fiscal years 2013, 2012 and 2011 is as follows:

(in millions, except per share amounts) 2013 2012 2011

Basic Earnings Per Share

Numerator:

Net income ....................................... $421 $394 $376

Denominator:

Weighted-average shares outstanding .................. 222 231 231

Effect of vested deferred stock units ............... — 1 1

Basic weighted-average shares outstanding .............. 222 232 232

Basic earnings per share ................................. $1.90 $1.70 $1.62

Diluted Earnings Per Share

Numerator:

Net income ....................................... $421 $394 $376

Denominator:

Basic weighted-average shares outstanding .............. 222 232 232

Effect of dilutive securities:

Stock options .............................122

Restricted stock ...........................122

Diluted weighted-average shares outstanding ............ 224 236 236

Diluted earnings per share ............................... $1.88 $1.67 $1.59

The computation of diluted earnings per share excludes the effect of the potential exercise of options to

purchase approximately 0.8 million shares of stock for fiscal years 2013, 2012 and 2011, as the effect would have

been anti-dilutive.

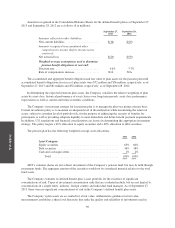

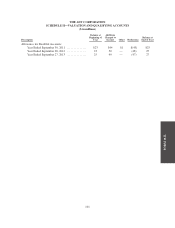

12. Geographic Data

Revenues are attributed to individual countries based upon the operating entity that records the transaction.

Revenue by geographic area for fiscal years 2013, 2012 and 2011 are as follows ($ in millions):

Revenue 2013 2012 2011

United States ...................................... $3,123 $3,034 $2,905

Canada ........................................... 186 194 205

Total ......................................... $3,309 $3,228 $3,110

Long-lived assets by geographic area as of September 27, 2013 and September 28, 2012 are as follows ($ in

millions):

Long-lived assets(1)

September 27,

2013

September 28,

2012

United States .............................. $4,785 $4,390

Canada ................................... 347 358

Total ................................. $5,132 $4,748

98