ADT 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

2014 Incentive Plan Design Changes

For fiscal year 2014, the Compensation Committee maintained the

same general AIP plan design as in fiscal year 2013, but made the

following changes to reflect the Company’s focus on further aligning

its incentive plans with stockholder interests:

•Replaced the Adjusted Free Cash Flow metric with Steady State

Free Cash Flow, which:

•captures the impact of key value drivers of the business;

•is the best proxy for assessing the economic potential of the

Company’s existing subscriber base; and

•is more aligned with metrics reported by key competitors, and

which is a common metric among companies in the security

industry.

•Replaced the Pulse Take Rate strategic modifier metric with

Recurring Revenue Margin, which is a metric intended to focus on

operating efficiency. Although increasing our Pulse Take Rate

remains a priority, particularly due to the fact that the ARPU for

Pulse customers is 25% greater than the ARPU for non-Pulse

customers, we continue to look to reduce the cost of operations,

particularly Cost to Serve and Subscriber Acquisition Costs. We

believe aligning our Annual Incentive Plan with a margin modifier

will provide our executives with the appropriate focus to reduce

our cost of operations.

For fiscal year 2014, the Compensation Committee approved the

following changes to the design of the LTIP:

•Adjusted the weighting of the equity mix for our Executive Officers.

The value of awards granted in conjunction with the annual grant

process will now be split as follows: 25% Stock Options, 25%

RSUs and 50% PSUs. The change to reduce the weighting of

Stock Options was recommended to the Compensation

Committee by our external advisors, Farient, to increase the

weighting on performance-based equity, and to recognize the fact

that dividends, which are accounted for through DEUs in PSUs

and RSUs, but not accounted for in stock options, have become

a more important part of total return to stockholders. The change

also aligns the equity mix for the CEO with the mix for other

Executive Officers.

•Similar to the change made in the Annual Incentive Plan, replaced

the Adjusted Free Cash Flow Growth metric with Steady State

Free Cash Flow Growth. The weighting of the Steady State Free

Cash Flow Growth metric was set at 50% of the PSU total.

•Replaced the Recurring Revenue Growth metric with Relative

TSR. We believe that Relative TSR is a metric that will

appropriately capture the overall performance of the Company in

comparison to the broader market, as reflected in our stock price

and adjusted for dividends. The Company’s Absolute Total

Shareholder Return (“Absolute TSR”) over the performance period

will be compared relative to the median Absolute TSR of

companies in the S&P 500 Index. In order to minimize the impact

of any short-term volatility in the price of the Company’s common

stock, Relative TSR will be measured utilizing a 60-day trailing

average at both the beginning and ending of the performance

period. The weighting of the Relative TSR metric was set at 50%

of the PSU total.

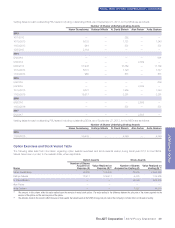

Executive Benefits and Perquisites

Our Executive Officers, including the CEO and other NEOs, are

eligible to participate in the benefit plans that are available to

substantially all of our U.S. employees, including our 401(k)

Retirement Savings and Investment Plan (“RSIP”), our medical, dental

and life insurance plans and long-term disability plans. Additionally,

the Company provides relocation benefits when a move is required.

None of our NEOs participate in a defined benefit pension plan.

Supplemental Savings and Retirement Plan

Executive Officers are also eligible to participate in the Company’s

Supplemental Savings and Retirement Plan (the “SSRP”), a deferred

compensation plan that permits the elective deferral of base salary

and annual performance-based bonus for executives earning more

than $115,000 per year. The SSRP provides eligible employees the

opportunity to:

•contribute retirement savings in addition to amounts permitted

under the Company’s RSIP;

•defer compensation on a tax-deferred basis and receive tax-

deferred market-based growth; and

•receive any Company contributions that were reduced under the

RSIP due to Internal Revenue Service compensation limits.

Executive Physical Program

The Company strongly believes in investing in the health and well-

being of its executives as an important component in providing

continued effective leadership for the Company. As such, we

maintain an annual executive physical program, for which all of our

Executive Officers are eligible. The program allows for expenses for

an annual physical to be paid for by the Company, up to a total of

$3,000 per year.

Policies and Practices

The Company maintains certain policies and practices to ensure that

its compensation programs appropriately align the interests of its

executives with the interests of stockholders.

Change in Control and Severance Benefits

Our Executive Officers, including the CEO and other NEOs, may be

eligible for certain benefits under either The ADT Corporation

Severance Plan for U.S. Officers and Executives (the “Severance

Plan”) or The ADT Corporation Change in Control Severance Plan (the

“CIC Severance Plan”), depending upon the circumstances leading to

their termination of service of employment with the Company. In the

case of the CIC Severance Plan, a “double trigger” is required before

benefits become available to the executives covered by that plan.

Details with respect to the key provisions of the severance plans

currently in effect and the payments and benefits that would be

payable under the plans are set forth in the section titled “Potential

Payments Upon Termination or Change in Control” below.

30 The ADT Corporation 2014 Proxy Statement

PROXY STATEMENT