ADT 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

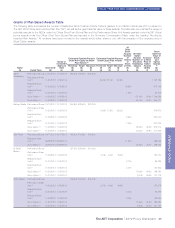

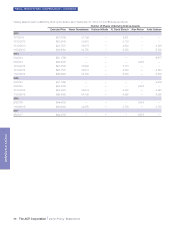

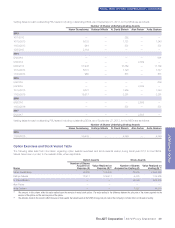

FISCAL YEAR 2013 NEO COMPENSATION—CONTINUED

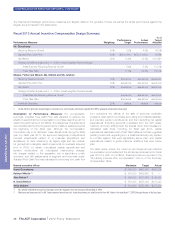

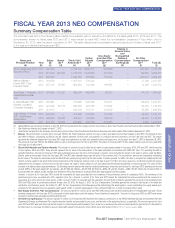

(1) Amounts reported in columns (d) through (f) represent potential annual performance bonuses that the named executive officers could have earned under the Company’s Officer Short-Term

Bonus Plan for fiscal year 2013. The range of potential payouts is based upon the Guideline Formula the Compensation Committee uses to exercise its available “negative discretion” under

the plan. The Compensation Committee established a maximum payout of 200% of target. Threshold amounts assume minimum performance levels are achieved with respect to each

performance measure. For Mr. Ferber, amounts represent the annualized threshold, target and maximum, although his actual bonus opportunity was pro-rated based upon his hire date as

discussed above. Upon her resignation from the Company during the fiscal year, Ms. Mikells forfeited her award.

(2) Amounts in (g) through (i) represent potential share payouts with respect to PSU awards that were made in connection with the fiscal year 2013 long-term incentive grant. PSU awards will

vest at the end of the three-year performance period, based upon the Company’s performance against its Recurring Revenue Growth and Adjusted Free Cash Flow Growth targets. The

threshold amounts shown above reflect the number of shares which would be delivered assuming that threshold attainment was met for both performance metrics. The maximum amounts

shown assume maximum attainment against both performance metrics. PSUs accrue dividend equivalent units, but these equivalents are ultimately delivered to the recipient only to the extent

that the underlying awards vest based upon performance.

(3) Amounts in column (m) show the grant date fair value of the Stock Option, RSU and PSU awards granted to the NEOs. These amounts represent the fair value of the entire amount of the

award calculated in accordance with Financial Accounting Standards Board ASC Topic 718 (ASC Topic 718), excluding the effect of estimated forfeitures. For grants of Stock Options,

amounts are computed by multiplying the fair value of the award (as determined under the Black-Scholes option pricing model) by the total number of options granted. For grants of RSUs,

fair value is computed by multiplying the total number of shares subject to the award by the closing price of the Company’s common stock on the date of grant. For grants of PSUs, fair value

is based on a model that considers the closing price of the Company’s common stock on the date of grant, the range of shares subject to such stock award, and the estimated probabilities of

vesting outcomes. The value of PSUs included in the table assumes target performance. However, the actual number of shares that will be delivered with respect to the PSUs will be

determined based on performance through the end of the three-year performance period.

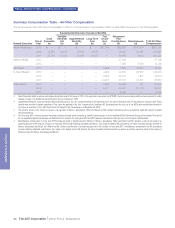

(4) Amounts represent grants of PSUs, RSUs and/or Stock Options with respect to our annual long-term incentive plan.

(5) Amounts represent grants of RSUs and Stock Options with respect to a one-time Founders’ Award.

(6) During fiscal year 2013, the Compensation Committee elected not to renew the Supplemental Executive Insurance Benefit policies that Mr. Gursahaney received as a benefit with his service

as a Tyco executive. The Compensation Committee made a one-time grant of RSUs to Mr. Gursahaney as a “buyout” of the value of these benefit policies. The RSUs vest in equal installments

over two years and had a grant date fair value equal to two times the annual value of the Supplemental Executive Insurance Benefit.

(7) Amounts represent grants of RSUs and Stock Options with respect to a sign-on equity award for Mr. Ferber.

The Company made its annual grant of equity for fiscal year 2013 in November 2012. The annual award for each of our NEOs (excluding

Mr. Ferber, whose grant of equity was not made as part of the annual grant process) consisted of a mix of PSUs, RSUs and Stock Options. In

addition, each of our NEOs other than Mr. Ferber received Founders’ Awards in fiscal year 2013 in the form of RSUs and Stock Options. For

Stock Options (including those granted to Mr. Ferber), the exercise price equals the closing price of the Company’s common stock on the date

of grant. Stock Options granted as part of the annual award process generally vest in equal installments over a period of four years, while those

options granted in the form of Founders’ Awards vest in equal installments over a period of three years. Each option holder has 10 years to

exercise his or her Stock Option from the date of grant, unless forfeited earlier. PSUs generally vest at the end of a three-year performance cycle,

with the number of shares delivered dependent on the achievement of applicable performance criteria. Anywhere between zero and 200% of the

target number shares may be delivered based on performance. PSUs generally accrue dividend equivalent units, which are subject to the same

performance conditions applicable to the underlying award, but do not carry voting rights. RSUs granted as part of the annual award process

generally vest in equal installments over four years, accrue dividend equivalent units subject to the same vesting restrictions as the underlying

award, and do not carry voting rights. RSUs granted as part of the Founders’ Award vest fully on the third anniversary of the grant date.

36 The ADT Corporation 2014 Proxy Statement

PROXY STATEMENT