ADT 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

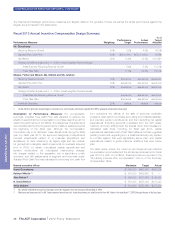

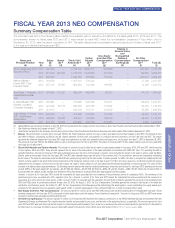

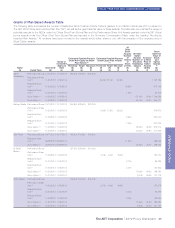

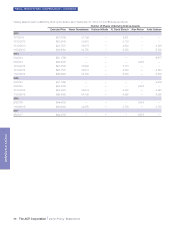

FISCAL YEAR 2013 NEO COMPENSATION—CONTINUED

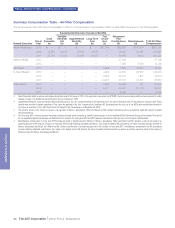

Summary Compensation Table – All Other Compensation

The components of the “All Other Compensation” column in the Summary Compensation Table for each NEO are shown in the following table.

Supplemental Executive Insurance Benefits

Named Executive Fiscal

Year

Cash

Perquisite

(a)

Variable

Universal

Life

(b)

Supplemental

Disability

(b)

Long-Term

Care

(b)

Tax

Gross-

Ups

(c)

Retirement

Plan

Contributions

(d) Miscellaneous

(e) Total All Other

Compensation

Naren Gursahaney 2013 $ — $ — $ — $ — $52,165 $53,607 $161,514 $267,286

2012 15,250 10,109 15,008 19,274 — 70,225 23,091 152,957

2011 59,750 10,109 15,008 19,275 — 86,665 9,614 200,421

Kathryn Mikells 2013 — — — — — 27,009 — 27,009

2012 — — — — — 7,395 5,000 12,395

Alan Ferber 2013 — — — — 5,699 7,500 34,644 47,843

N. David Bleisch 2013 — — — — 4,993 24,868 96,543 126,404

2012 — — — — 2,602 24,327 7,987 34,916

2011 — — — — 44,978 33,179 20,801 98,958

Anita Graham 2013 — — — — 3,268 28,906 301 32,475

2012 — — — — 5,877 35,091 23,119 64,087

2011 — — — — — 6,305 — 6,305

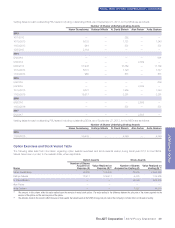

(a) Cash Perquisites reflect an annual cash perquisite payment equal to the lesser of 10% of the executive’s base salary and $70,000. Payments were made quarterly and were adjusted to reflect

changes in salary. This benefit was discontinued by Tyco as of January 1, 2012.

(b) Supplemental Executive Insurance Benefits reflect premiums paid by Tyco for insurance benefits for the executive and, in the case of long-term care, for the executive’s spouse as well. These

benefits were provided to certain executives of Tyco upon the approval of the Tyco Compensation Committee. Mr. Gursahaney was the only one of our NEOs who received these benefits in

his role as an executive of Tyco. ADT discontinued this benefit for Mr. Gursahaney as of November 30, 2012.

(c) The amounts shown in this column as tax gross-up payments for Messrs. Gursahaney, Ferber and Bleisch and Ms. Graham represent tax gross-up payments made with respect to taxable

relocation expenses.

(d) For fiscal year 2013, amounts represent matching contributions made by the Company on behalf of each executive to its tax-qualified 401(k) Retirement Savings and Investment Plan and to

its non-qualified Supplemental Savings and Retirement Plan. Amounts for fiscal years 2012 and 2011 represent contributions made by Tyco to similar plans it administered.

(e) Miscellaneous compensation in fiscal year 2013 includes the value of taxable relocation benefits for Messrs. Gursahaney, Ferber and Bleisch and Ms. Graham, as well as the value of an

executive physical for Mr. Bleisch. Amounts for fiscal year 2012 include matching charitable contributions Tyco made on behalf of Mr. Gursahaney, the value of taxable relocation benefits for

Messrs. Gursahaney and Bleisch, Ms. Mikells and Ms. Graham, and the value of an executive physical for Ms. Graham. In fiscal year 2011, miscellaneous compensation for Mr. Gursahaney

includes matching charitable contributions Tyco made on his behalf, and for Mr. Bleisch, the value of taxable relocation benefits, as well as de minimis payments made for the vesting of

fractional shares for Messrs. Gursahaney and Bleisch.

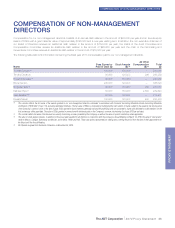

34 The ADT Corporation 2014 Proxy Statement

PROXY STATEMENT