ADT 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

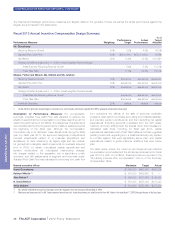

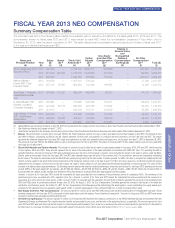

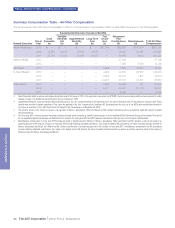

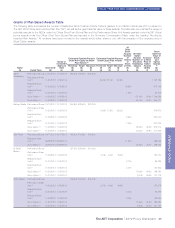

FISCAL YEAR 2013 NEO COMPENSATION—CONTINUED

Outstanding Equity Awards at Fiscal Year-End Table

The following table shows outstanding Stock Option awards classified as exercisable and unexercisable and the number and value of any

unvested or unearned equity awards outstanding as of September 27, 2013 for each of the NEOs. The value of any unvested or unearned

equity awards outstanding is calculated based on a market value of $41.26, which was the NYSE closing price per share of the Company’s

common stock on September 27, 2013.

Option Awards (1) Stock Awards

Name

Number of

Securities

Underlying

Unexercised

Options: (#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options: (#)

UnExercisable

Option

Exercise

Price

($)

Option

Expiration

Date

Number of

Shares or Units

of Stock That

Have Not Vested

(#)(2)

Market Value of

Shares or Units

of Stock That

Have Not

Vested

($)(3)

Equity

Incentive Plan

Awards:

Number of

Unearned

Shares, Units

or Other Rights

That Have Not

Vested

(#)(4)

Equity Incentive

Plan Awards:

Market or

Payout Value of

Unearned

Shares, Units or

Other Rights

That Have Not

Vested

($)(3)

Naren 31,138 — 36.4222 3/9/2015 94,890 3,915,161 38,535 1,589,954

Gursahaney 39,309 — 29.5082 11/21/2015

14,741 — 31.1718 1/11/2016

137,587 — 30.8309 11/20/2016

110,850 — 34.1771 7/2/2017

54,644 — 28.4959 8/17/2018

201,873 — 18.5745 10/6/2018

111,474 37,159 21.6169 9/30/2019

61,982 61,983 23.8843 10/11/2020

26,073 78,220 28.3870 10/11/2021

— 131,400 45.9000 11/29/2022

— 65,700 45.9000 11/29/2022

Kathryn

Mikells (5)

—— — —

N. David 11,792 — 31.3397 6/19/2015 20,164 831,967 4,349 179,440

Bleisch 8,352 — 29.5082 11/21/2015

10,515 — 30.8309 11/20/2016

11,491 — 34.1771 7/2/2017

14,410 — 18.5745 10/6/2018

7,892 2,631 21.6169 9/30/2019

10,234 10,234 23.8843 10/11/2020

4,519 13,560 28.3870 10/11/2021

— 9,300 45.9000 11/29/2022

— 15,000 45.9000 11/29/2022

Alan Ferber — 38,700 44.4700 5/7/2023 11,234 463,515 —

Anita 6,679 13,356 31.1796 5/3/2021 21,200 874,712 4,349 179,440

Graham (6) 4,839 14,520 28.3870 10/11/2021

— 9,300 45.9000 11/29/2022

— 15,000 45.9000 11/29/2022

(1) Stock Options granted to the NEOs generally vest and become exercisable one-fourth per year on each anniversary of the grant date. Stock Options granted to the NEOs in conjunction with

the Founders’ Awards in fiscal year 2013 vest and become exercisable one-third per year on each anniversary of the grant date. Stock Options granted to the NEOs expire on the day prior to

the tenth anniversary of the grant date.

(2) The amounts shown in this column represent unvested awards of RSUs. Amounts include outstanding dividend equivalent units associated with the underlying RSU awards.

(3) The amounts in these columns represent the market value of the unvested RSU and PSU awards calculated using a price of $41.26, which was the closing price of the Company’s Common

Stock on the NYSE on September 27, 2013.

(4) The amounts shown in this column represent outstanding and unvested awards of PSUs. The number of PSUs is based on the number granted (target amount) and includes outstanding

dividend equivalent units associated with the underlying award. Dividend equivalent units will vest only to the extent the underlying awards vest based upon the Company’s performance

against its performance targets. The three-year performance period for the fiscal year 2013 grant ends on the last day of fiscal year 2015.

(5) Ms. Mikells’ employment with the Company terminated on May 2, 2013. In accordance with the treatment of equity upon termination of employment as defined in The ADT Corporation 2012

Stock and Incentive Plan, and in the terms and conditions of her individual equity awards, all outstanding RSUs, PSUs and unvested Stock Options were cancelled upon her date of

termination. Ms. Mikells had a period of 90 days post-termination to exercise any vested stock options, after which period any unvested stock options were cancelled.

(6) Ms. Graham’s employment with the Company terminated on December 31, 2013. In accordance with the treatment of equity upon termination of employment as defined in The ADT

Corporation 2012 Stock and Incentive Plan, and in the terms and conditions of her individual equity awards, all outstanding RSUs, PSUs and unvested Stock Options were cancelled upon

her date of termination. Ms. Graham has a period of 90 days post-termination to exercise any vested stock options, after which period any unvested stock options will be cancelled.

The ADT Corporation 2014 Proxy Statement 37

PROXY STATEMENT