ADT 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Gross Subscriber Acquisition Cost Expenses. Gross subscriber acquisition cost expenses represent the cost of

acquiring new customers reflected in our Consolidated and Combined Statements of Operations and include

advertising, marketing, and both direct and indirect selling costs for all new accounts as well as sales

commissions and installation equipment and labor costs.

Earnings before interest, taxes, depreciation and amortization (“EBITDA”). EBITDA is a non-GAAP measure

reflecting net income adjusted for interest, taxes and certain non-cash items which include depreciation of

subscriber system assets and other fixed assets, amortization of deferred costs and deferred revenue associated

with customer acquisitions, and amortization of dealer and other intangible assets. We believe EBITDA is useful

to provide investors with information about operating profits, adjusted for significant non-cash items, generated

from the existing customer base. A reconciliation of EBITDA to net income (the most comparable GAAP

measure) is provided under “Results of Operations—Non-GAAP Measures.”

Free Cash Flow (“FCF”). FCF is a non-GAAP measure that our management employs to measure cash that is

free from any significant existing obligation and is available to service debt and make investments. The

difference between net cash provided by operating activities (the most comparable GAAP measure) and FCF is

the deduction of cash outlays for capital expenditures, subscriber system assets, dealer generated customer

accounts and bulk account purchases. A reconciliation of FCF to net cash provided by operating activities is

provided under “Results of Operations—Non-GAAP Measures.”

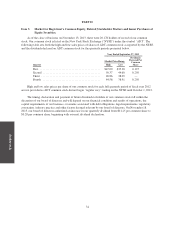

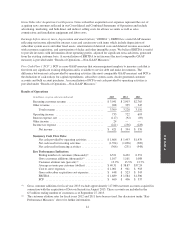

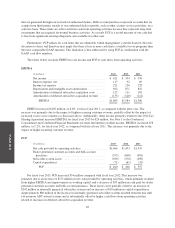

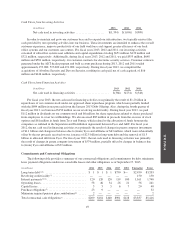

Results of Operations

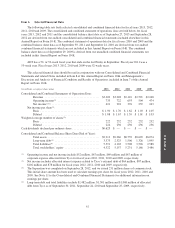

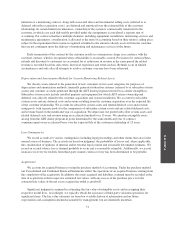

(in millions, except as otherwise indicated) 2013 2012 2011

Recurring customer revenue ......................... $3,041 $ 2,903 $2,765

Other revenue .................................... 268 325 345

Total revenue ................................. 3,309 3,228 3,110

Operating income ................................. 735 722 693

Interest expense, net ............................... (117) (92) (89)

Other income ..................................... 24 — —

Income tax expense ................................ (221) (236) (228)

Net income ................................... $ 421 $ 394 $ 376

Summary Cash Flow Data:

Net cash provided by operating activities ........... $1,666 $ 1,493 $1,439

Net cash used in investing activities ............... (1,394) (1,096) (909)

Net cash used in financing activities ............... (366) (231) (548)

Key Performance Indicators:

Ending number of customers (thousands)(1) ......... 6,521 6,422 6,351

Gross customer additions (thousands)(1) ............ 1,107 1,161 1,088

Customer attrition rate (percent)(2) ................ 13.9% 13.5% 12.7%

Average revenue per customer (dollars) ............ $40.31 $ 38.87 $37.24

Cost to serve expenses .......................... $1,001 $ 961 $ 918

Gross subscriber acquisition cost expenses .......... $ 448 $ 523 $ 543

EBITDA ..................................... $1,689 $ 1,584 $1,506

FCF ........................................ $ 460 $ 406 $ 537

(1) Gross customer additions for fiscal year 2013 exclude approximately 117,000 customer accounts acquired in

connection with the acquisition of Devcon Security in August 2013. These accounts are included in the

6.5 million ending number of customers as of September 27, 2013.

(2) The customer attrition rates for fiscal years 2012 and 2011 have been revised. See discussion under “Key

Performance Measures” above for further information.

41