ADT 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Notices and the Partnership Notices exclude interest and do not reflect the impact on subsequent periods if the

IRS challenge to Tyco’s tax filings is proved correct. Tyco has filed petitions with the U.S. Tax Court to contest

the IRS assessments. Consistent with its petitions filed with the U.S. Tax Court, Tyco has advised the Company

that it strongly disagrees with the IRS position and believes (i) it has meritorious defenses for the respective tax

filings, (ii) the IRS positions with regard to these matters are inconsistent with applicable tax laws and Treasury

regulations, and (iii) the previously reported taxes for the years in question are appropriate. If the IRS should

successfully assert its position, the Company’s share of the collective liability, if any, would be determined

pursuant to the 2012 Tax Sharing Agreement. In accordance with the 2012 Tax Sharing Agreement, the amount

ultimately assessed under the Tyco IRS Notices and the Partnership Notices would have to be in excess of $1.85

billion before the Company would be required to pay any of the amounts assessed. The Company believes that its

income tax reserves and the liabilities recorded in the consolidated balance sheet for the 2012 Tax Sharing

Agreement continue to be appropriate. No payments with respect to these matters would be required until the

dispute is resolved in the U.S. Tax Court, which Tyco has advised the Company, could take several years.

However, the ultimate resolution of these matters is uncertain, and if the IRS were to prevail, it could have a

material adverse impact on the Company’s financial condition, results of operations and cash flows, potentially

including a reduction in the Company’s available net operating loss carryforwards. Further, to the extent ADT is

responsible for any liability under the 2012 Tax Sharing Agreement, there could be a material impact on its

financial position, results of operations, cash flows or its effective tax rate in future reporting periods.

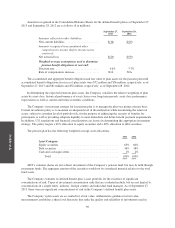

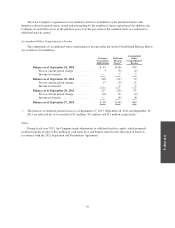

Other liabilities in the Company’s Consolidated Balance Sheets as of both September 27, 2013 and

September 28, 2012 include $19 million for the fair value of ADT’s obligations under certain tax related

agreements entered into in conjunction with the Separation. The maximum amount of potential future payments

is not determinable as they relate to unknown conditions and future events that cannot be predicted.

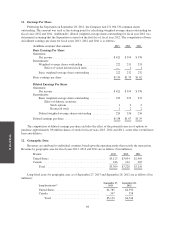

8. Retirement Plans

The Company measures its retirement plans as of its fiscal year end.

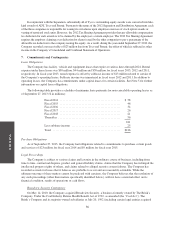

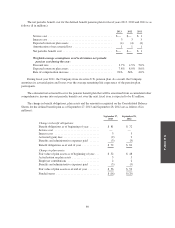

Defined Benefit Pension Plan—The Company sponsors one noncontributory defined benefit retirement plan

covering certain of its U.S. employees. Net periodic pension benefit cost is based on periodic actuarial valuations

which use the projected unit credit method of calculation and is charged to the Consolidated and Combined

Statements of Operations on a systematic basis over the expected average remaining service lives of current

participants. Contribution amounts are determined based on U.S. regulations and the advice of professionally

qualified actuaries. The benefits under the defined benefit plan are based on various factors, such as years of

service and compensation.

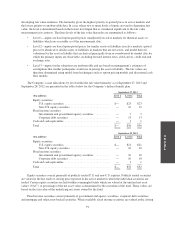

Prior to the Separation, the plan was a commingled plan and included plan participants of other Tyco

subsidiaries. Therefore, for periods prior to September 28, 2012, the Company recorded its portion of the

commingled plan expense and the related obligations, which had been actuarially determined based on the

Company’s specific benefit formula by participant and allocated plan assets. The contribution amounts for

periods prior to the Separation were determined in total for the commingled plan and allocated to the Company

based on headcount. In conjunction with the Separation, the plan was legally separated, and assets were

reallocated based on the ERISA prescribed calculation.

88