ADT 2013 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

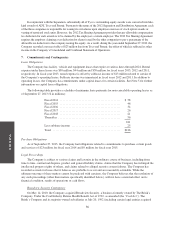

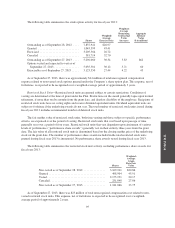

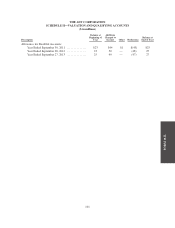

The following table summarizes the stock option activity for fiscal year 2013:

Shares

Weighted-

Average

Exercise Price

Weighted-

Average

Remaining

Contractual

Term

(in years)

Aggregate

Intrinsic

Value

($ in millions)

Outstanding as of September 28, 2012 .... 7,837,941 $26.97

Granted ............................ 1,045,399 45.41

Exercised ........................... 3,205,566 26.72

Canceled ........................... 381,714 32.70

Outstanding as of September 27, 2013 .... 5,296,060 30.34 5.83 $62

Options vested and expected to vest as of

September 27, 2013 ................. 5,035,301 30.12 5.71 60

Exercisable as of September 27, 2013 ..... 3,123,350 27.44 4.22 43

As of September 27, 2013, there was approximately $14 million of total unrecognized compensation

expense related to non-vested stock options granted under the Company’s share option plan. This expense, net of

forfeitures, is expected to be recognized over a weighted-average period of approximately 3 years.

Restricted Stock Units—Restricted stock units are granted subject to certain restrictions. Conditions of

vesting are determined at the time of grant under the Plan. Restrictions on the award generally lapse upon normal

retirement, if more than twelve months from the grant date, and death or disability of the employee. Recipients of

restricted stock units have no voting rights and receive dividend equivalent units. Dividend equivalent units are

subject to forfeiture if the underlying awards do not vest. The total number of restricted stock units issued during

fiscal year 2013 includes an immaterial number of deferred stock units.

The fair market value of restricted stock units, both time vesting and those subject to specific performance

criteria, are expensed over the period of vesting. Restricted stock units that vest based upon passage of time

generally vest over a period of four years. Restricted stock units that vest dependent upon attainment of various

levels of performance (“performance share awards”) generally vest in their entirety three years from the grant

date. The fair value of all restricted stock units is determined based on the closing market price of the underlying

stock on the grant date. The number of performance share awards included in the total restricted stock units

granted during fiscal year 2013 is immaterial. No performance share awards vested during fiscal year 2013.

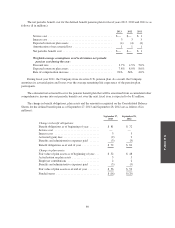

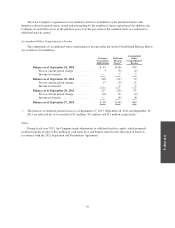

The following table summarizes the restricted stock unit activity, including performance share awards, for

fiscal year 2013:

Shares

Weighted-

Average

Grant-

Date Fair

Value

Non-vested as of September 28, 2012 ............... 3,169,241 $20.86

Granted ....................................... 498,904 45.91

Vested ........................................ 2,175,231 20.17

Canceled ...................................... 251,848 27.86

Non-vested as of September 27, 2013 ............... 1,241,066 33.75

As of September 27, 2013, there was $23 million of total unrecognized compensation cost related to non-

vested restricted stock units. This expense, net of forfeitures is expected to be recognized over a weighted-

average period of approximately 2 years.

95