ADT 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

that are generated through our network of authorized dealers. Bulk account purchases represent accounts that we

acquire from third parties outside of our authorized dealer network, such as other security service providers, on a

selective basis. These items are subtracted from cash from operating activities because they represent long-term

investments that are required for normal business activities. As a result, FCF is a useful measure of our cash that

is free from significant existing obligations and available for other uses.

Furthermore, FCF adjusts for cash items that are ultimately within management’s and the board of directors’

discretion to direct and therefore may imply that there is less or more cash that is available for our programs than

the most comparable GAAP measure. This limitation is best addressed by using FCF in combination with the

GAAP cash flow numbers.

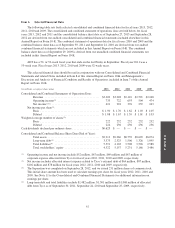

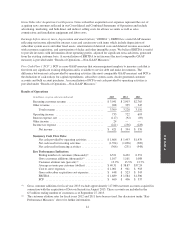

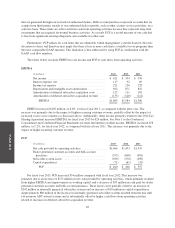

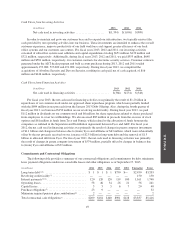

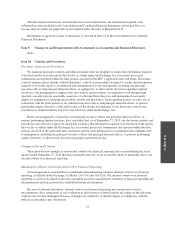

The tables below reconcile EBITDA to net income and FCF to cash flows from operating activities.

EBITDA

(in millions) 2013 2012 2011

Net income ........................................ $ 421 $ 394 $ 376

Interest expense, net ................................. 117 92 89

Income tax expense ................................. 221 236 228

Depreciation and intangible asset amortization ............ 942 871 825

Amortization of deferred subscriber acquisition costs . . . . . . . 123 111 102

Amortization of deferred subscriber acquisition revenue .... (135) (120) (114)

EBITDA ...................................... $1,689 $1,584 $1,506

EBITDA increased $105 million, or 6.6%, for fiscal year 2013, as compared with the prior year. The

increase was primarily due to the impact of higher recurring customer revenue, partially offset by the impact of

increased cost to serve expenses as discussed above. Additionally, other income primarily related to the 2012 Tax

Sharing Agreement increased EBITDA for fiscal year 2013 by $24 million. See Note 1 to the Condensed,

Consolidated and Combined Financial Statements for more information on other income. EBITDA increased $78

million, or 5.2%, for fiscal year 2012, as compared with fiscal year 2011. This increase was primarily due to the

impact of higher recurring customer revenue.

FCF

(in millions) 2013 2012 2011

Net cash provided by operating activities ................ $1,666 $1,493 $1,439

Dealer generated customer accounts and bulk account

purchases ....................................... (555) (648) (581)

Subscriber system assets ............................. (580) (378) (290)

Capital expenditures ................................. (71) (61) (31)

FCF.......................................... $ 460 $ 406 $ 537

For fiscal year 2013, FCF increased $54 million compared with fiscal year 2012. This increase was

primarily due to an increase of $173 million in net cash provided by operating activities, which primarily resulted

from higher EBITDA and improvements in working capital, and a decrease of $93 million in cash paid for dealer

generated customer accounts and bulk account purchases. These factors were partially offset by an increase of

$202 million in internally generated subscriber systems and an increase of $10 million in capital expenditures.

Approximately $80 million of the increase in internally generated subscriber systems resulted from the mix shift

toward more ADT-owned systems and is substantially offset by higher cash flows from operating activities

related to increases in deferred subscriber acquisition revenue.

46