ADT 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

additional incentives for our executives to focus on sustainable, long-

term growth.

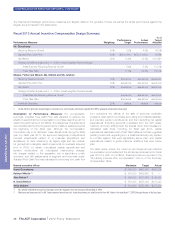

As a new public company beginning in fiscal year 2013, the

Compensation Committee felt it was important to set aggressive

targets in our incentive plans in order to focus our executives on

taking appropriate actions to ensure the Company is well-positioned

for long-term success. In fiscal year 2013, we did not fully meet the

aggressive financial targets set in our Annual Incentive Plan, but

outperformed against the strategic modifier metrics (see the

performance targets and actual performance in “Fiscal Year 2013

Annual Incentive Compensation Design Summary” below). As a

result, our CEO was awarded an annual incentive equal to 77% of his

targeted annual payout. Our other NEOs (with the exception of

Ms. Mikells, who forfeited her annual incentive award when she

resigned from the Company during the fiscal year) received an

average payout of 74.2% of their targeted award, including the impact

of their performance against individual objectives. The Compensation

Committee believes this result reflects proper alignment of pay and

performance. The Compensation Committee set equally aggressive

targets for fiscal year 2014 to ensure the relationship with

performance continues.

The fiscal year 2013 long-term incentive programs were also

designed to reward management for performance directly related to

increasing stockholder value. Our CEO received 50%, and the other

executives 40%, of long-term incentive value in stock options, which

deliver value only when long-term stock price appreciation is

achieved. The remaining 50% of the long-term incentive value for our

CEO and an additional 40% for the other executives was comprised

of Performance Share Units (“PSUs”), where vesting of shares is

contingent upon achieving Recurring Revenue Growth and Adjusted

Free Cash Flow Growth goals over a three-year performance period.

Our NEOs other than the CEO received 20% of their long-term

incentive value in Restricted Stock Units (“RSUs”), which deliver

higher value when there is long-term stock price appreciation.

Although the Company did not utilize a Total Shareholder Return

(“TSR”) metric in our fiscal year 2013 compensation programs, we

tracked our TSR throughout the year for two main purposes:

•as an additional data point in the overall assessment of

performance of the Company, particularly as we assessed the

performance of our executives relative to their compensation; and

•in anticipation of potentially utilizing a TSR metric in future years’

long-term incentive compensation design.

The Compensation Committee has determined that, in order to better

align our executive compensation with the value created for our

stockholders, Relative TSR will replace the Recurring Revenue Growth

metric as a metric for the PSUs granted during the 2014 fiscal year.

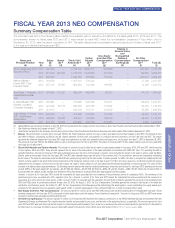

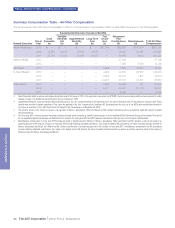

The following graph provides a comparison of the cumulative total

shareholder return on the Company’s common stock to the returns of

the Standard & Poor’s (“S&P”) 500 Index and the S&P 500 Industrial

Index from October 1, 2012 (the first day of fiscal year 2013) through

September 27, 2013. The graph is not, and is not intended to be,

indicative of future performance of our common stock.

The above graph assumes the following:

(1) $100 invested at the close of business on October 1, 2012, in

ADT common stock, S&P 500 Index, and the S&P 500 Industrial

Index.

(2) The cumulative total return assumes reinvestment of dividends.

The Compensation Committee believes that the annual incentive

awards earned by the NEOs, in comparison to the performance of

the Company’s stock relative to the S&P 500 Index and the S&P 500

Industrial Index, reflect a proper alignment of pay and performance.

Process for Determining Executive Officer

Compensation (including NEOs)

Role of the Compensation Committee

The Compensation Committee consists exclusively of independent

directors also considered “outside directors” as defined in

Section 162(m) of the Internal Revenue Code (the “Code”), and is

responsible for, among other things, reviewing the performance of

and approving the compensation awarded to our Executive Officers,

other “senior officers” subject to the filing requirements of Section 16

24 The ADT Corporation 2014 Proxy Statement

PROXY STATEMENT