ADT 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.None of the services described above was approved by the Audit Committee under the de minimus

exception provided by Rule 2-01(c)(7)(i)(C) under Regulation S-X.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent

Auditors

In March 2004, the Audit Committee adopted a pre-approval policy that provides guidelines for

the audit, audit-related, tax and other permissible non-audit services that may be provided by the

independent auditors. The policy identifies the guiding principles that must be considered by the Audit

Committee in approving services to ensure that the auditors’ independence is not impaired. The policy

provides that the Corporate Controller will support the Audit Committee by providing a list of

proposed services to the Committee, monitoring the services and fees pre-approved by the Committee,

providing periodic reports to the Audit Committee with respect to pre-approved services, and ensuring

compliance with the policy.

Under the policy, the Audit Committee annually pre-approves the audit fee and terms of the

engagement, as set forth in the engagement letter. This approval includes approval of a specified list of

audit, audit-related and tax services. Any service not included in the specified list of services must be

submitted to the Audit Committee for pre-approval. No service may extend for more than 12 months,

unless the Audit Committee specifically provides for a different period. The independent auditor may

not begin work on any engagement without confirmation of Audit Committee pre-approval from the

Corporate Controller or his or her delegate.

In accordance with the policy, the Chair of the Audit Committee has been delegated the authority

by the Committee to pre-approve the engagement of the independent auditors when the entire

Committee is unable to do so. The Chair must report all such pre-approvals to the Audit Committee at

the next Committee meeting.

PROPOSAL NUMBER THREE—APPROVAL OF THE AMENDMENT AND RESTATEMENT OF

THE TYCO 2004 STOCK AND INCENTIVE PLAN

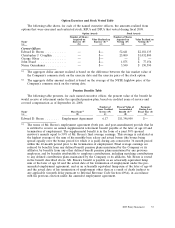

Our shareholders are being asked to consider and vote on a proposal to amend and restate (the

‘‘Amendments’’) the Tyco International Ltd. 2004 Stock and Incentive Plan (the ‘‘Plan’’). The

Amendment of the Plan was approved by our Board of Directors on January 14, subject to the

approval of shareholders. Approval of the Amendments to the Plan requires the affirmative vote of a

majority of the common shares represented in person or by proxy at the Annual General Meeting.

Awards under the current Plan may be structured to qualify as ‘‘performance-based compensation’’

that is exempt from the $1 million limit on tax-deductible compensation imposed by Section 162(m) of

the Internal Revenue Code. To satisfy the requirements that apply to performance-based compensation,

and continue the ability to grant performance-based compensation awards, we are requesting

shareholder re-approval of the performance measures described in the Plan, which must occur no later

than the first shareholder meeting that occurs in the fifth year following the year in which shareholders

previously approved the performance measures, which in Tyco’s case was 2004. If shareholders approve

the Amendments to the Plan, it will be effective as of January 1, 2009. If shareholders do not approve

the Amendments to the Plan, the Amendments will have no effect. In such a case, awards may

continue to be granted under the Plan as it currently exists without amendment, but Tyco will

thereafter be unable to structure certain awards to be exempt from the limitation on tax deductible

compensation of $1 million.

2009 Proxy Statement 59