ADT 2008 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

16. Commitments and Contingencies (Continued)

The Company and its subsidiaries’ income tax returns periodically are examined by various tax

authorities. See ‘‘Other Income Tax Matters’’ in note 6.

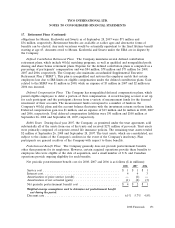

Class Action Settlement and Legacy Securities Matters

As a result of actions taken by certain of the Company’s former senior corporate management,

Tyco, some members of the Company’s former senior corporate management, including its former

General Counsel, are named defendants in a number of actions alleging violations of the disclosure

provisions of the federal securities laws. In addition, Tyco, certain of its current and former employees,

some members of the Company’s former senior corporate management are named as defendants in

several Employee Retirement Income Security Act (‘‘ERISA’’) class actions. The Company is generally

obligated to indemnify its directors and officers who are named as defendants in some or all of these

matters to the extent required by Bermuda law.

The Company has settled a number of legacy securities lawsuits in 2008 and 2007. During the third

quarter of 2008, the Company signed a definitive agreement with the plaintiff to settle the lawsuit

entitled New Jersey v. Tyco International Ltd., et al. In connection with the settlement, the Company

made a payment of $73.25 million to the plaintiffs on June 2, 2008. Pursuant to the Separation and

Distribution Agreement, the Company’s share of the settlement amount was approximately $20 million,

with Covidien and Tyco Electronics responsible for approximately $30 million and $23 million,

respectively. The Company recorded the settlement and related receivables from each of Covidien and

Tyco Electronics for their respective shares of the settlement amount in the second quarter of 2008

resulting in a net charge to selling, general and administrative expenses for its share of the settlement

of approximately $20 million.

Also in the third quarter of 2008, the Company settled the lawsuit entitled Ballard v. Tyco

International Ltd. Pursuant to the settlement, the Company made a payment of $36 million to the

plaintiffs, which was subject to the sharing formula contained in the Separation and Distribution

Agreement and resulted in the Company recording a net charge to selling, general and administrative

expense of approximately $10 million and recording receivables from Tyco Electronics and Covidien of

approximately $11 million and $15 million, respectively, in the third quarter.

In 2007, the Company settled 32 purported securities class action lawsuits arising from actions

alleged to have been taken by prior management for $2.975 billion. Of this amount, the Company

contributed $803 million, representing its share under the Separation and Distribution Agreement, to a

$2.975 billion escrow account established in connection with the settlement. All legal contingencies that

could have affected the final order approving the settlement expired on February 21, 2008, and the

claims administrator for the settlement class is currently processing claims. The settlement did not

purport to resolve all securities cases, and several of such cases remain outstanding. In addition, the

settlement did not release claims arising under ERISA and the lawsuits arising thereunder. As of the

opt-out deadline, Tyco had received opt-out notices from individuals and entities totaling approximately

4% of the shares owned by class members. A number of these individuals and entities have filed claims

separately against Tyco. Any judgments resulting from such claims or from claims that are filed in the

future would not reduce the settlement amount. Generally, the claims asserted by these plaintiffs

include claims similar to those asserted by the settling defendants; namely, violations of the disclosure

provisions of federal securities laws. Tyco intends to vigorously defend any litigation resulting from

opt-out claims. It is not possible to predict the final outcome or to estimate the amount of loss or

range of possible loss, if any, that might result from an adverse resolution of the asserted or unasserted

142 2008 Financials