ADT 2008 Annual Report Download - page 269

Download and view the complete annual report

Please find page 269 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

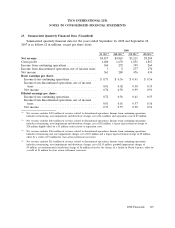

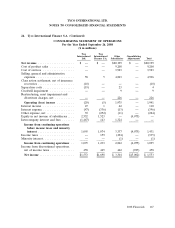

23. Summarized Quarterly Financial Data (Unaudited) (Continued)

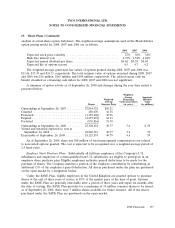

2007

1st Qtr.(1) 2nd Qtr.(2) 3rd Qtr.(3) 4th Qtr.(4)

Net revenue .................................. $4,336 $4,487 $ 4,702 $4,952

Gross profit .................................. 1,482 1,502 1,598 1,678

Income (loss) from continuing operations ............ 158 163 (3,054) 209

Income (loss) from discontinued operations, net of

income taxes ............................... 635 672 (497) (28)

Net income (loss) ............................. 793 835 (3,551) 181

Basic earnings per share:

Income (loss) from continuing operations .......... $ 0.32 $ 0.33 $ (6.17) $ 0.42

Income (loss) from discontinued operations, net of

income taxes .............................. 1.28 1.36 (1.01) (0.06)

Net income (loss) ............................ 1.60 1.69 (7.18) 0.36

Diluted earnings per share:

Income (loss) from continuing operations .......... 0.31 0.33 (6.17) 0.42

Income (loss) from discontinued operations, net of

income taxes .............................. 1.26 1.33 (1.01) (0.06)

Net income (loss) ............................ 1.57 1.66 (7.18) 0.36

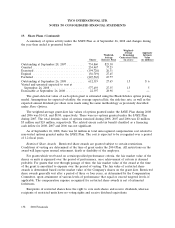

(1) Net revenue excludes $6,023 million of revenue related to discontinued operations. Income from continuing operations

includes restructuring, asset impairment and divestiture charges net, of $57 million, and separation costs of $25 million.

(2) Net revenue excludes $6,351 million of revenue related to discontinued operations. Income from continuing operations

includes restructuring, asset impairment and divestiture charges, net of $46 million and separation costs of $32 million.

(3) Net revenue excludes $6,465 million of revenue related to discontinued operations. Income from continuing operations

includes a class action settlement charge, net of $2.875 billion, a $259 million charge related to loss on early extinguishment

of debt, a goodwill impairment charge of $46 million, restructuring, asset impairment and divestiture charges, net of

$48 million and separation costs of $28 million.

(4) Net revenue excludes $432 million of revenue related to discontinued operations. Income from continuing operations

includes restructuring, asset impairment and divestiture charges, net of $60 million, separation costs of $20 million, a

$13 million insurance recovery related to the class action settlement, and $10 million of charges related to a Voluntary

Replacement Program. Income tax provision includes the negative impact of approximately $58 million related to changes in

valuation allowances, reserve adjustments and nondeductible costs, partially offset by favorable adjustments of approximately

$48 million related to prior periods.

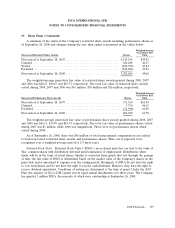

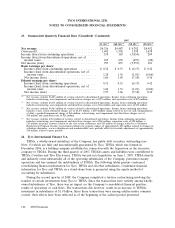

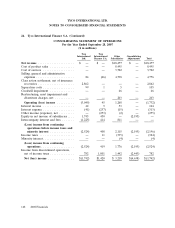

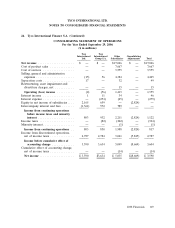

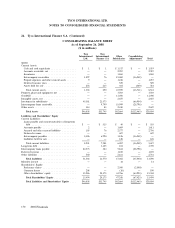

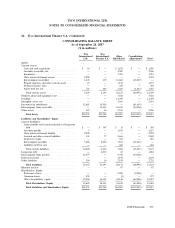

24. Tyco International Finance S.A.

TIFSA, a wholly-owned subsidiary of the Company, has public debt securities outstanding (see

Note 13) which are fully and unconditionally guaranteed by Tyco. TIFSA, which was formed in

December 2006, is a holding company established in connection with the Separation as the successor

company to TIGSA. During the third quarter of 2007, TIGSA’s assets and liabilities were contributed to

TIFSA, Covidien and Tyco Electronics. TIGSA was put into liquidation on June 1, 2007. TIFSA directly

and indirectly owns substantially all of the operating subsidiaries of the Company, performs treasury

operations and has assumed the indebtedness of TIGSA. The following tables present condensed

consolidating financial information for Tyco, TIFSA and all other subsidiaries. Condensed financial

information for Tyco and TIFSA on a stand-alone basis is presented using the equity method of

accounting for subsidiaries.

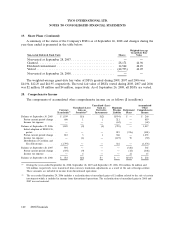

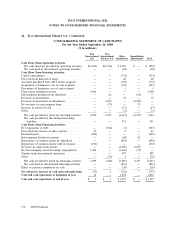

During the second quarter of 2008, the Company completed a tax-free restructuring involving the

transfer of certain investments from Tyco to TIFSA. Since the transactions were entirely among wholly-

owned subsidiaries of Tyco, there was no impact on the Company’s consolidated financial position,

results of operations or cash flows. The transactions did, however, result in an increase to TIFSA’s

investment in subsidiaries of $1.9 billion. Since these transactions were among entities under common

control, their effects have been reflected as of the beginning of the earliest period presented.

166 2008 Financials