ADT 2008 Annual Report Download - page 257

Download and view the complete annual report

Please find page 257 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

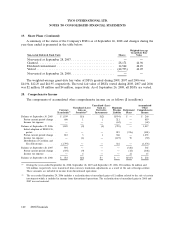

18. Shareholders’ Equity (Continued)

Share Repurchase Program—On July 10, 2008, Tyco’s Board of Directors approved a $1.0 billion

share repurchase program. In September 2007 and May 2006, Tyco’s Board of Directors approved share

repurchase programs of $1.0 billion and $2.0 billion, respectively. During the fourth quarter of 2008,

the Company repurchased 7.3 million shares for $290 million, of which 2.5 million common shares was

repurchased for $100 million under the 2008 share repurchase program and 4.8 million shares was

repurchased for $190 million under the 2007 share repurchase program. During fiscal 2008, the

Company repurchased 23.1 million common shares for $944 million completing the 2007 $1.0 billion

share repurchase program. During 2007, the Company repurchased 1.3 million common shares for

$56 million under the 2007 $1.0 billion share repurchase program and 5 million common shares for

$659 million completing the 2006 $2.0 billion share repurchase program. During 2006, the Company

repurchased 11 million common shares for $1.2 billion completing the 2005 $1.5 billion share

repurchase program and 13 million common shares for $1.3 billion under the 2006 $2.0 billion share

repurchase program.

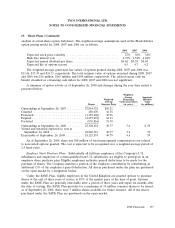

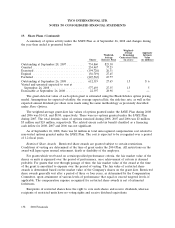

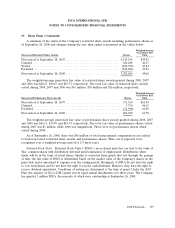

19. Share Plans

In connection with the Separation in 2007, share options were modified through the issuance of

Covidien and Tyco Electronics share options. As a result of the one for four share split, share option

exercise prices for the Tyco awards were adjusted. Generally, employee share options converted into

share options of the employer with the exception of corporate employees whose awards converted into

share options of all three companies. The revisions made to the share options as a result of the

Separation constituted a modification under the provisions of SFAS No. 123R, ‘‘Share-based Payment,’’

which requires a comparison of fair values of the share options immediately before the Separation and

the fair values immediately after the Separation. In certain instances, the fair value immediately after

the Separation was higher. As a result, the modification resulted in incremental compensation cost of

$15 million. Of this amount, $1 million and $13 million ($11 million in discontinued operations) were

recorded in 2008 and 2007, respectively. The 2008 amount is included in selling, general and

administrative expenses while the 2007 amount is included in separation costs on the Company’s

Consolidated Statements of Operations. The remaining balance will be recorded in continuing

operations over the remaining vesting period of the share options. Except for the changes described,

the principal terms of the share options remain unchanged from the original grant.

Also in connection with the Separation, Tyco employee restricted share awards and restricted stock

units (collectively, ‘‘restricted share awards’’) were modified through the issuance of Covidien and Tyco

Electronics restricted shares or the conversion to shares of the employer. Restricted shares and

restricted share units held by employees in the company in which they were not employed were subject

to accelerated vesting provisions and vested 50% on the first day of trading after the Separation and

50% six months thereafter. This accelerated vesting resulted in $14 million of accelerated compensation

expense for Tyco’s continuing operations. Tyco recorded $12 million as selling, general and

administrative expenses in the fourth quarter of 2007 and recorded the remaining expense in the first

quarter of 2008. Equity awards under the Save-As-You-Earn Plan (the ‘‘SAYE Plan’’) were not

modified in connection with the Separation thereby resulting in additional compensation expense of

$14 million. Of this amount, $7 million ($1 million in discontinued operations) and $5 million

($2 million in discontinued operations) were recorded in 2008 and 2007, respectively. The balance of

$2 million will be recorded over the remaining vesting period through the second quarter of 2009.

154 2008 Financials