ADT 2008 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

10. Investments (Continued)

to be of high credit quality and interest has been paid when due and (iii) the Company has the intent

and ability to hold such investments until a recovery in the market value occurs or the securities

mature. The Company does not believe any unrealized losses represent an other-than-temporary

impairment based on its evaluation of available evidence as of September 26, 2008. If in the future the

Company determines that any decline in value of the securities is other-than-temporary, the Company

would have to recognize the loss in its Consolidated Statements of Operations. Unrealized gains and

losses are recorded in accumulated other comprehensive income in the Company’s Consolidated

Balance Sheets.

The Company recorded an other-than-temporary impairment of $5 million for the year ended

September 26, 2008. The other-than-temporary impairment related to investments in corporate debt of

Lehman Brothers Holding, Inc (‘‘Lehman’’), which filed a petition under Chapter 11 of the U.S.

Bankruptcy Code with the U.S. Bankruptcy Court for the Southern District of New York on

September 15, 2008. Other than the Lehman impairment, the Company did not record any additional

other-than-temporary impairment in the years ended September 28, 2007 and September 29, 2006.

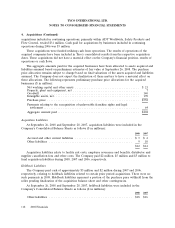

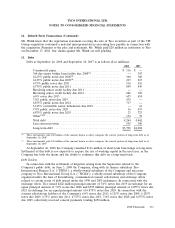

The maturities of the Company’s investments in debt securities as of September 26, 2008 are as

follows (in millions):

Cost Fair

Basis Value

Due in one year or less ................................................ $ 67 $ 67

Due after one year through five years ...................................... 249 235

Due after five years through ten years ..................................... 1 1

11. Goodwill and Intangible Assets

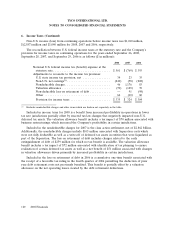

Annually, and more frequently if triggering events occur, the Company tests goodwill for

impairment by comparing the fair value of each reporting unit with its carrying amount. Fair value for

the goodwill impairment test is determined utilizing a discounted cash flow analysis based on the

Company’s future budgets discounted using the Company’s weighted average cost of capital and market

indicators of terminal year cash flows. Other valuation methods are used to corroborate the discounted

cash flow method. If the carrying amount of a reporting unit exceeds its fair value, goodwill is

considered potentially impaired. During the annual goodwill impairment testing for the fiscal year

ended September 26, 2008, the carrying amount of goodwill in the Latin America Fire Protection

business, part of the Fire Protection Services segment, exceeded the implied fair value of goodwill. As a

result, the Company recognized a goodwill impairment of $9 million in the fourth quarter of 2008.

Furthermore, the Company believes that its goodwill balance at September 26, 2008 is recoverable.

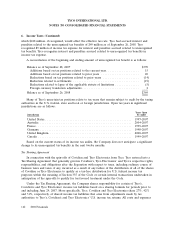

In connection with the Separation, during the third quarter of 2007 Tyco reorganized into a new

management and segment reporting structure. As part of these organizational changes, the Company

assessed new reporting units and conducted valuations to determine the assignment of goodwill to the

new reporting units based on their estimated relative fair values. Following the relative fair value

goodwill allocation, the Company then tested goodwill for impairment by comparing the fair value of

each reporting unit with its carrying value amount. If the carrying amount of a reporting unit exceeded

its fair value, goodwill was considered potentially impaired. Where goodwill was potentially impaired,

the Company compared the implied fair value of the reporting unit goodwill to the carrying amount of

that goodwill. The carrying amount of goodwill exceeded the implied fair value of goodwill in the

128 2008 Financials