ADT 2008 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23.1 million common shares for $944 million in 2008 completing the 2007 $1.0 billion share repurchase

program. During 2007, we repurchased 1.3 million common shares for $56 million under the 2007

$1.0 billion share repurchase program as well as 5 million common shares for $659 million completing

the 2006 $2.0 billion share repurchase program. During 2006, we repurchased 13 million common

shares for $1.3 billion under the 2006 $2.0 billion share repurchase program as well as 11 million

common shares for $1.2 billion completing the 2005 $1.5 billion share repurchase program.

During the first quarter of 2007, we launched a company-wide restructuring program, which as of

September 26, 2008 has been substantially completed. Since the inception of this program, we have incurred

charges of $395 million relating to this program. During 2008, 2007 and 2006 we paid out $187 million,

$70 million and $32 million, respectively, in cash related to restructuring activities. We have identified

additional opportunities for cost savings from restructuring activities in fiscal 2009 and expect to incur

restructuring charges of approximately $50 million in fiscal 2009. See Note 3 to our Consolidated Financial

Statements for further information regarding our restructuring activities.

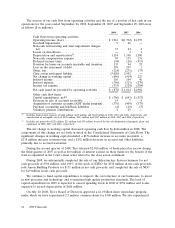

Income taxes paid, net of refunds, related to continuing operations was $501 million, $649 million,

and $316 million in 2008, 2007, and 2006, respectively.

During 2008, 2007 and 2006, Tyco paid $376 million, $409 million and $373 million of cash,

respectively, to acquire approximately 370,000, 415,000 and 401,000 customer contracts for electronic

security services through the ADT dealer program.

During 2008, 2007 and 2006, we paid $2 million, $10 million and $7 million, respectively, in cash

for purchase accounting and holdback liabilities. Holdback liabilities represent a portion of the

purchase price withheld from the seller pending finalization of the acquisition balance sheet and other

contingencies. At September 26, 2008 holdback liabilities on our Consolidated Balance Sheets were

$18 million, which are included in other liabilities. At September 26, 2008, $12 million of acquisition

liabilities remained on our Consolidated Balance Sheets, of which $3 million are included in accrued

and other current liabilities and $9 million are included in other liabilities.

As previously discussed, effective June 29, 2007, we completed the Separation. In connection with

the Separation, we paid $68 million, $349 million and $96 million in Separation costs during 2008, 2007

and 2006, respectively. Of these amounts, $36 million, $256 million and $77 million were included in

cash flows from discontinued operating activities, respectively.

As previously discussed, we continue to be active in refining our portfolio and assessing the

strategic fit of our various businesses. As a result, we will continue to divest of businesses that do not

align with our overall strategy. We plan to use the expected proceeds from these sales, as well as the

cash generated by our operations, to continue to make investments in our businesses that are intended

to grow revenue and improve productivity, including our restructuring actions. We expect to also use

cash to selectively pursue acquisitions. Additionally, we expect to continue to return any excess cash to

our shareholders through share repurchases and dividend payments.

Pursuant to our share repurchase program, we may repurchase Tyco shares from time to time in

open market purchases at prevailing market prices, in negotiated transactions off the market, or

pursuant to an approved 10b5-1 trading plan in accordance with applicable regulations.

Management believes that cash generated by or available to us should be sufficient to fund our

capital and liquidity needs for the foreseeable future, including quarterly dividend payments. The

Company intends to repurchase additional shares under its existing $1.0 billion share repurchase

program depending on credit market conditions, macroeconomic factors and expectations regarding

future cash flows.

2008 Financials 67