ADT 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

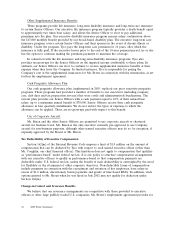

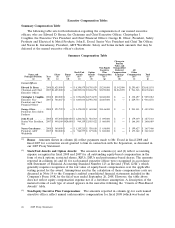

The table below shows the maximum and target bonus payments set by the annual incentive plan

for fiscal 2008, and the actual bonus payments that each of our named executive officers received.

These amounts are reported in the ‘‘Non-Equity Incentive Plan Compensation’’ column of the

‘‘Summary Compensation’’ table.

Fiscal Year 2008 Performance Bonus Summary

Named Executive Officer (Current) Maximum(1) Target Actual

Edward Breen ..................................... $4,062,500 $1,625,000 $3,250,000

Christopher Coughlin ............................... $2,000,000 $ 800,000 $1,600,000

George Oliver ..................................... $1,500,000 $ 600,000 $1,146,000

John Evard ....................................... $ 862,500 $ 345,000 $ 690,000

Naren Gursahaney .................................. $1,400,000 $ 560,000 $ 638,000

(1) In November 2007, the Board approved maximum bonus payouts of 0.50% of net income before

special items for Mr. Breen, subject to a cap of $5.0 million imposed by the 2004 SIP, and 0.25%

for the other Senior Officers, subject to a cap of $2.5 million. At the same time, for purposes of

the annual incentive plan, the Compensation Committee established a maximum payout of 200%

of target, plus or minus 25% based on individual qualitative performance measures.

The Board approved performance bonus payouts for each of our named executive officers in

November 2008. The Board approved the bonuses based on (i) the achievement of the quantitative

performance measures shown in the ‘‘Annual Incentive Compensation Design Summary’’ above and

(ii) the achievement of certain qualitative performance measures, which for Mr. Breen consisted of

measures related to growth, operational excellence, management of our business portfolio, and talent

development. These qualitative goals were set forth in the Chief Executive Officer performance

scorecards which the Board regularly reviews. Similar qualitative goals were set forth for each of the

other named executive officers.

Long-Term Incentive Awards

The Company grants long-term equity incentive awards (‘‘LTI compensation’’) to Senior Officers as

part of its overall executive compensation strategy. For a description of the material terms of stock

options, RSUs and performance shares granted under the 2004 SIP, see the narrative following the

‘‘Grants of Plan-Based Awards’’ table.

The Compensation Committee believes that LTI compensation serves the Company’s executive

compensation philosophy in several ways. It helps attract, retain and motivate talent. It aligns the

interests of the named executive officers with those of shareholders by linking a significant portion of

the officer’s total pay opportunity to share price. It provides long-term accountability for named

executive officers. And it offers the incentive of performance-based opportunities for capital

accumulation in lieu of a pension plan for most of the Company’s executive management.

Fiscal 2008 Equity Awards

The annual equity awards that our named executive officers would have received during fiscal 2008

were actually granted in the third quarter of fiscal 2007, immediately after the Separation. This was

done to align our named executive officers and other key employees with the long-term performance of

post-Separation Tyco. (The accelerated equity awards were reported in the ‘‘Grants of Plan Based

Awards’’ table included in our proxy statement for the 2008 Annual General Meeting). The

Compensation Committee structured the fiscal 2008 awards so that 1⁄3 would be in stock options, 1⁄3 in

RSUs, and 1⁄3 in performance shares. The purpose of this structure was to reward the named executive

officers for their contributions to any appreciation in the value of new Tyco’s common shares over time;

36 2009 Proxy Statement