ADT 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

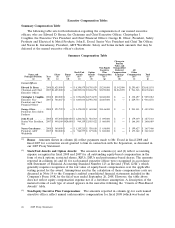

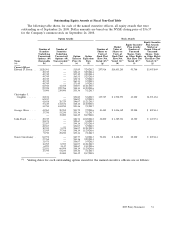

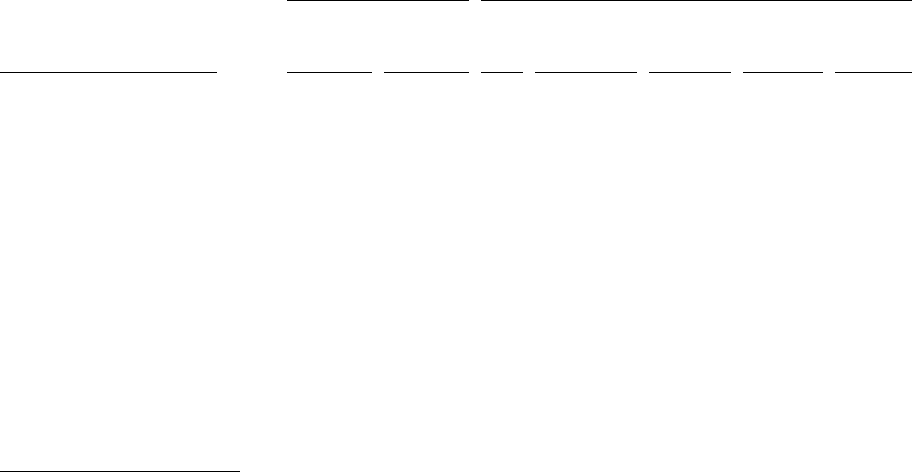

Potential Payments Upon Termination and Change in Control

The following table summarizes the severance benefits that would have been payable to each of

the named executive officers upon his termination of employment or upon the occurrence of a change

in control, assuming that the triggering event or events occurred on September 26, 2008. The amounts

shown are based on Tyco’s closing NYSE share price of $36.37 on such date.

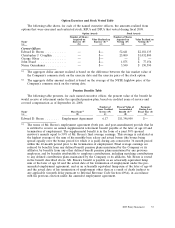

For Mr. Breen, termination benefits are governed by his employment agreement. For each of the

other named executive officers, the CIC Severance Plan governs termination benefits for

change-in-control triggering events, and the Severance Plan governs termination benefits for all other

triggering events. In all cases, a ‘‘Qualified Termination’’ means a termination following a change in

control that would provide the executive with a ‘‘Good Reason’’ to terminate his employment, as

defined under the CIC Severance Plan or under Mr. Breen’s employment agreement. For the definition

of ‘‘Good Reason’’ and ‘‘Cause’’ under the relevant documents, see the discussion under the heading

‘‘Change in Control and Severance Benefits.’’ Under his employment agreement, Mr. Breen could

terminate his employment for ‘‘Good Reason’’ by voluntarily resigning within the 30-day period

following the first anniversary of a change in control, in which case he would be entitled to severance

and the benefit and perquisite continuation described in column (c).

Mr. Breen’s employment agreement with the Company was amended on December 19, 2008.

Among other changes, the amended agreement reduced certain of the benefits, including cash

payments, that he is entitled to upon a termination or change in control, as described above under the

heading ‘‘Change in Control and Severance Benefits.’’ Because the table below presents amounts that

would have been payable to the named executive officers as of Tyco’s fiscal year end, the amounts

shown reflect the benefits payable under Mr. Breen’s pre-amended employment agreement and the

pre-amended Severance Plan and CIC Severance Plan.

Change in Control Involuntary Termination

Without With Without

Qualified Qualified With Cause or With Death or

Name / Form of Compensation Termination Termination Cause Good Reason Resignation Disability Retirement

(a) (b) (c) (d) (e) (f) (g) (h)

Edward D. Breen

Severance(1) .................. — $14,659,997 — $14,659,997 — — —

Benefit & Perquisite Continuation(2) . . . — $ 330,751 — $ 330,751 — — —

Accelerated Vesting of Equity Awards(3) . $14,285,989 $14,285,989 — $14,285,989 — $10,869,965 —

Retirement Plan Distributions(4) ...... $14,222,954 $14,222,954 — $ 3,315,916 — — —

Excise Tax Gross-Up(5) ........... — $11,641,270 — — — — —

Christopher J. Coughlin

Severance(1) .................. — $4,784,000 — $ 3,200,000 — — —

Benefit & Perquisite Continuation(2) . . . — $ 32,443 — $ 24,037 — — —

Accelerated Vesting of Equity Awards(3) . $ 6,509,757 $ 6,509,757 — — — $ 4,938,573 —

George Oliver

Severance(1) .................. — $2,400,000 — $ 2,400,000 — — —

Benefit & Perquisite Continuation(2) . . . — $ 24,037 — $ 24,037 — — —

Accelerated Vesting of Equity Awards(3) . $ 3,843,763 $ 3,843,763 — — — $ 3,036,349 —

John Evard

Severance(1) .................. — $2,406,950 — $ 1,610,000 — — —

Benefit & Perquisite Continuation(2) . . . — $ 32,443 — $ 24,037 — — —

Accelerated Vesting of Equity Awards(3) . $ 1,138,852 $ 1,138,852 — — — $ 691,501 —

Naren Gursahaney

Severance(1) .................. — $1,556,580 — $ 2,240,000 — — —

Benefit & Perquisite Continuation(2) . . . — $ 24,037 — $ 24,037 — — —

Accelerated Vesting of Equity Awards(3) . $ 3,429,727 $ 3,429,727 — — — $ 2,622,313 —

(1) For Mr. Breen, severance under his pre-amended employment agreement was based on three times

his base salary and three times his actual bonus for fiscal 2008. Under the amended agreement, the

multiplier has been reduced to two times, with further reductions applicable when Mr. Breen

reaches specified ages. The severance amount includes a tax gross-up payment to the State of New

York of $34,997. For each of the other named executive officers, severance would be paid under

either the CIC Severance Plan (if the triggering event were a change of control) or the Severance

2009 Proxy Statement 55