ADT 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283

|

|

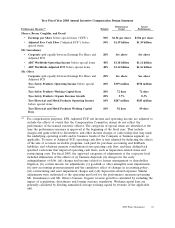

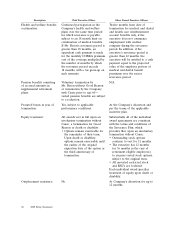

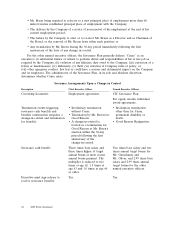

Tyco Fiscal Year 2008 Annual Incentive Compensation Design Summary

Performance Actual

Performance Measure(1) Weights Target Performance

Messrs. Breen, Coughlin, and Evard

•Earnings per Share before special items (‘‘EPS’’) 50% $2.56 per share $3.06 per share

•Adjusted Free Cash Flow (‘‘Adjusted FCF’’) before 50% $1.19 billion $1.30 billion

special items

Mr. Gursahaney

•Corporate split equally between Earnings Per Share and 20% See above See above

Adjusted FCF

•ADT Worldwide Operating Income before special items 40% $1.18 billion $1.11 billion

•ADT Worldwide Adjusted FCF before special items 40% $1.14 billion $1.16 billion

Mr. Oliver

Corporate split equally between Earnings Per Share and 20% See above See above

Adjusted FCF

Tyco Safety Products Operating Income before special 20% $339 million $358 million

items

Tyco Safety Products Working Capital Days 20% 72 days 72 days

Tyco Safety Products Organic Revenue Growth 20% 5.7% 8.3%

Tyco Electrical and Metal Products Operating Income 10% $207 million $385 million

before special items

Tyco Electrical and Metal Products Working Capital 10% 92 days 89 days

Days

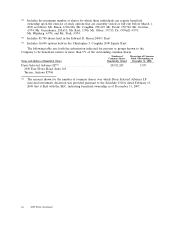

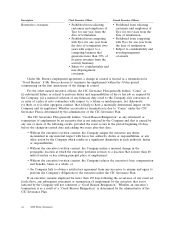

(1) For compensation purposes, EPS, Adjusted FCF, net income and operating income are adjusted to

exclude the effects of events that the Compensation Committee deems do not reflect the

performance of the named executive officers. The categories of special items are identified at the

time the performance measure is approved at the beginning of the fiscal year. They include

charges and gains related to divestitures, and other income charges or cash outlays that may mask

the underlying operating results and/or business trends of the Company or business segment, as

applicable. To arrive at Adjusted FCF, operating cash flow is first adjusted by deducting the effects

of the sale of accounts receivable programs, cash paid for purchase accounting and holdback

liabilities, and voluntary pension contributions from operating cash flow, and then adding back

specified cash items that impacted operating cash flows, such as Separation-related items and

restructuring costs. For fiscal 2008, the approved categories of adjustments at the corporate level

included elimination of the effects of (i) business disposals, (ii) charges for the early

extinguishment of debt, (iii) charges and income related to former management or shareholder

litigation, (iv) certain income tax adjustments, (v) goodwill or other intangible asset impairments,

(vi) new accounting pronouncements and the cumulative effect of changes in accounting policy,

(vii) restructuring and asset impairment charges and (viii) Separation-related expenses. Similar

adjustments were authorized at the operating unit level for the performance measures governing

Mr. Gursahaney’s and Mr. Oliver’s bonuses. Organic revenue growth is calculated by excluding the

impact of acquisitions, divestitures and foreign currency translation. Working capital days are

generally calculated by dividing annualized average working capital by revenue of the applicable

unit.

2009 Proxy Statement 35