ADT 2008 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

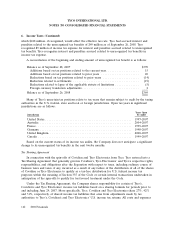

2. Divestitures (Continued)

In January 2008, the Company sold a European manufacturer of public address products and

acoustic systems which was part of the Company’s Fire Protection Segment and recorded an $8 million

pre-tax loss on sale. The loss was recorded in income from discontinued operations, net of income

taxes in the Company’s Consolidated Statement of Operations.

During the first quarter of 2007, Aquas Industriales de Jose, C.A. (‘‘AIJ’’), a joint venture that was

majority owned by Infrastructure Services, was sold for $42 million in net cash proceeds and a pre-tax

gain of $19 million was recorded. The gain was recorded in discontinued operations, net of income

taxes in the Company’s Consolidated Statement of Operations. AIJ was part of the Company’s

Corporate and Other segment.

During the third quarter of 2007, Tyco completed the Separation and has presented its Healthcare

and Electronics businesses as discontinued operations in all periods presented.

In each period prior to the Separation, net interest and loss on early extinguishment of debt, which

is included in other expense, net in the Consolidated Statements of Operations, amounts were

proportionally allocated to Covidien and Tyco Electronics based on the debt amounts that Tyco believes

were utilized by Covidien and Tyco Electronics historically inclusive of amounts directly incurred.

Allocated net interest was calculated using our historical weighted-average interest rate on debt

including the impact of interest rate swap agreements. These allocated amounts were included in

discontinued operations. During 2007, allocated interest income, interest expense and other expense,

net was $35 million, $242 million and $388 million, respectively. During 2006, allocated interest income,

interest expense and other expense, net was $53 million, $378 million and $0 million, respectively.

During 2007, the Company incurred pre-tax separation costs related primarily to professional

services and employee-related costs of $154 million and $289 million, respectively, in discontinued

operations.

Additionally, the year ended September 28, 2007 includes tax charges related to the Separation

primarily for the write-off of deferred tax assets that are no longer realizable of $88 million in

discontinued operations.

The Company has used available information to develop its best estimates for certain assets and

liabilities related to the Separation. In limited instances, final determination of the balances will be

made in subsequent periods. During the year ended September 28, 2007, $72 million was recorded

through shareholders’ equity, primarily related to a cash true-up adjustment of $57 million and

$15 million of other items. During the year ended September 26, 2008, $70 million of other items was

recorded through shareholders’ equity. The other items, which aggregate $85 million, reflect immaterial

adjustments to shareholders’ equity which were recorded to correct the distribution amount at the date

of Separation. Adjustments in the future for the impact of filing final income tax returns in certain

jurisdictions where those returns include a combination of Tyco, Covidien and/or Tyco Electronics legal

entities and for certain amended income tax returns for the periods prior to the Separation may be

recorded to either shareholders’ equity or the statement of income depending on the specific item

giving rise to the adjustment.

112 2008 Financials