ADT 2008 Annual Report Download - page 259

Download and view the complete annual report

Please find page 259 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

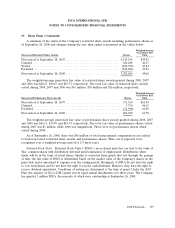

19. Share Plans (Continued)

common shares on or after January 1, 2004) and which are no longer available for any reason

(including the termination of the LTIP Plans) will also be available for issuance under the 2004 Plan.

When common shares are issued pursuant to a grant of Awards, the total number of common shares

remaining available for grant will be decreased by a margin of at least 1.8 per common share issued. At

September 26, 2008, there were approximately 34 million shares available for future grant under the

2004 Plan (including shares available under both the LTIP I and LTIP II Plans that are now assumable

under the 2004 Plan).

The 1994 Plan provided for the issuance of restricted stock grants to officers and non-officer

employees. The 1994 Plan expired in November 2004; thus no additional grants of restricted stock have

been made under this plan since November 2004 and no shares are available for future grant. At

September 26, 2008, 14 million shares had been granted, of which 10 million were granted under the

2004 Plan and 4 million were granted under the 1994 Plan.

The LTIP I Plan reserved common shares for issuance to Tyco’s directors, executives and managers

as share options. This plan was administered by the Compensation and Human Resources Committee

of the Board of Directors of the Company, which consisted exclusively of independent directors of the

Company. During 2008, there were approximately 0.5 million shares originally reserved for issuance

under this plan, which became available for future grant under the 2004 Plan.

The LTIP II Plan was a broad-based option plan for non-officer employees. The terms and

conditions of this plan were similar to the LTIP I Plan. During 2008, there were approximately

1.1 million shares originally reserved for issuance under this plan, which became available for future

grant under the 2004 Plan.

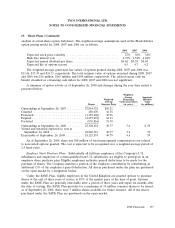

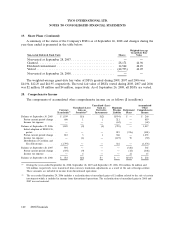

Share Options—Options are granted to purchase common shares at prices which are equal to or

greater than the market price of the common shares on the date the option is granted. Conditions of

vesting are determined at the time of grant under the 2004 Plan. Options are generally exercisable in

equal annual installments over a period of three or four years and will generally expire 10 years after

the date of grant. Historically, the Company’s practice has been to settle stock option exercises through

either newly issued shares or from shares held in treasury, which were repurchased by the Company.

At September 26, 2008, approximately 251 million share options had been granted, of which

138 million, 76 million and 37 million were granted under the LTIP I, LTIP II and 2004 Plans,

respectively.

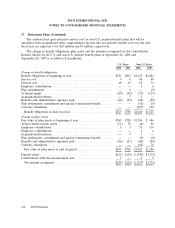

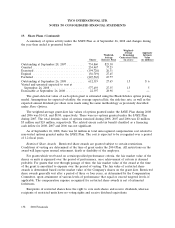

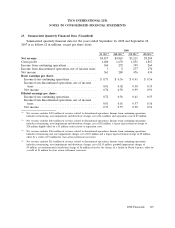

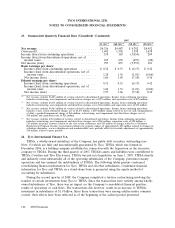

The grant-date fair value of each option grant is estimated using the Black-Scholes option pricing

model. The fair value is then amortized on a straight-line basis over the requisite service periods of the

awards, which is generally the vesting period. Use of a valuation model requires management to make

certain assumptions with respect to selected model inputs. Expected volatility was calculated based on

the historical volatility of the Company’s stock and implied volatility derived from exchange traded

options. Post-Separation, expected volatility was calculated based on an analysis of historic and implied

volatility measures for a set of peer companies. The average expected life was based on the contractual

term of the option and expected employee exercise and post-vesting employment termination behavior.

The risk-free interest rate is based on U.S. Treasury zero-coupon issues with a remaining term equal to

the expected life assumed at the date of grant. The compensation expense recognized is net of

estimated forfeitures. Forfeitures are estimated based on voluntary termination behavior, as well as an

156 2008 Financials