ADT 2008 Annual Report Download - page 228

Download and view the complete annual report

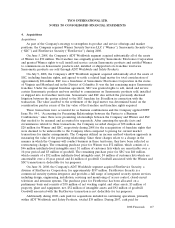

Please find page 228 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

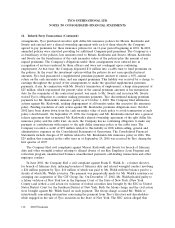

6. Income Taxes (Continued)

The IRS proposed civil fraud penalties against a prior subsidiary that was distributed to Tyco

Electronics arising from alleged actions of former executives in connection with intercompany transfers

of stock of Simplex Technologies in 1998 and 1999. Based on statutory guidelines, we estimate the

proposed penalties could range between $30 million and $50 million. The Company, as Audit Managing

Party as specified in the Tax Sharing Agreement, intends to vigorously oppose the assertion of any such

penalties against Tyco Electronics, in part, because beginning in 2003 the Company discovered,

investigated and reported the conduct at issue to the IRS and fully cooperated in the criminal

prosecution of the Company’s former Chief Tax Officer on a charge of willful filing of a false tax

return. This is a pre-Separation shared tax matter under the Tax Sharing Agreement.

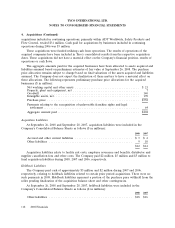

Except for earnings that are currently distributed, no additional material provision has been made

for U.S. or non-U.S. income taxes on the undistributed earnings of subsidiaries or for unrecognized

deferred tax liabilities for temporary differences related to investments in subsidiaries, as such earnings

are expected to be permanently reinvested, the investments are essentially permanent in duration, or

the Company has concluded that no additional tax liability will arise as a result of the distribution of

such earnings. A liability could arise if amounts are distributed by such subsidiaries or if such

subsidiaries are ultimately disposed. It is not practicable to estimate the additional income taxes related

to permanently reinvested earnings or the basis differences related to investments in subsidiaries.

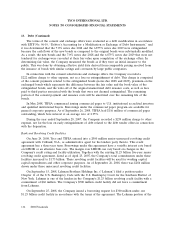

The calculation of our tax liabilities involves dealing with uncertainties in the application of

complex tax regulations in a multitude of jurisdictions across our global operations. We recognize

potential liabilities and record tax liabilities for anticipated tax audit issues in the U.S. and other tax

jurisdictions based on our estimate of whether, and the extent to which, additional taxes will be due.

These tax liabilities are reflected net of related tax loss carryforwards. We adjust these reserves in light

of changing facts and circumstances; however, due to the complexity of some of these uncertainties, the

ultimate resolution may result in a payment that is materially different from our current estimate of the

tax liabilities. Further, management has reviewed with tax counsel certain of the issues raised by these

taxing authorities and the adequacy of these recorded amounts. If the Company’s estimate of tax

liabilities proves to be less than the ultimate assessment, an additional charge to expense would result.

If payment of these amounts ultimately proves to be less than the recorded amounts, the reversal of

the liabilities may result in income tax benefits being recognized in the period when we determine the

liabilities are no longer necessary. Substantially all of these potential tax liabilities are recorded in other

liabilities on the Consolidated Balance Sheets as payment is not expected within one year.

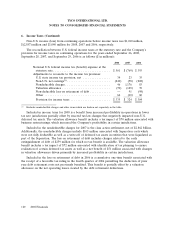

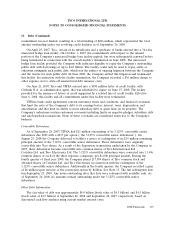

7. Cumulative Effect of Accounting Change

During 2006, the Company adopted FIN No. 47, ‘‘Accounting for Conditional Asset Retirement

Obligations—an Interpretation of FASB Statement No. 143.’’ FIN No. 47 clarifies the timing of liability

recognition for legal obligations associated with an asset retirement when the timing and (or) method

of settling the obligation are conditional on a future event that may or may not be within the control of

the entity and clarifies when an entity would have sufficient information to reasonably estimate the fair

value of an asset retirement obligation. FIN No. 47 requires that conditional asset retirement

obligations, along with the associated capitalized asset retirement costs, be initially reported at their fair

values. Upon adoption, the Company recognized a liability of $32 million for asset retirement

obligations and an increase of $10 million in the carrying amount of the related assets, of which

$19 million and $5 million are reflected in liabilities and assets of discontinued operations, respectively.

The initial recognition resulted in a cumulative effect of accounting change of $14 million after-tax loss

2008 Financials 125