ADT 2008 Annual Report Download - page 241

Download and view the complete annual report

Please find page 241 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Guarantees (Continued)

the actual number of sprinkler heads replaced. Actual results could differ from this estimate.

Settlements during 2008 include cash expenditures of $49 million related to the VRP.

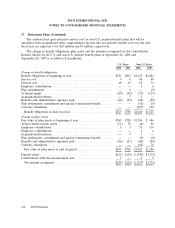

15. Financial Instruments

The Company’s financial instruments consist primarily of cash and cash equivalents, accounts

receivable, investments, accounts payable, debt and derivative financial instruments. The fair value of

cash and cash equivalents, accounts receivable, investments and accounts payable approximated book

value at September 26, 2008 and September 28, 2007. See Note 10 and Note 13 for the fair value of

investments and estimates of debt, respectively.

All derivative financial instruments are reported on the Consolidated Balance Sheets at fair value,

and changes in a derivative’s fair value are recognized currently in earnings unless specific hedge

criteria are met. Fair value estimates are based on relevant market information, including current

market rates and prices, assuming adequate market liquidity.

The Company uses derivative financial instruments to manage exposures to foreign currency and

interest rate risks. The Company’s objective for utilizing derivatives is to manage these risks using the

most effective methods to eliminate or reduce the impacts of these exposures. For those transactions

that are designated as hedges, the Company documents relationships between hedging instruments and

hedged items, and links derivatives designated as fair value, cash flow or foreign currency hedges to

specific assets and liabilities on the Consolidated Balance Sheets or to specific firm commitments or

forecasted transactions. For transactions designated as hedges, the Company also assesses and

documents, both at the hedge’s inception and on an ongoing basis, whether the derivatives that are

used in hedging transactions are effective in offsetting changes in fair values or cash flows associated

with the hedged items.

As part of managing the exposure to changes in market interest rates, the Company has historically

entered into various interest rate swap transactions with financial institutions acting as principal

counterparties. To ensure both appropriate use as a hedge and hedge accounting treatment, all

derivatives entered into were designated according to a hedge objective against fluctuations in interest

rates on specifically underwritten debt issuances. The Company’s primary hedge objectives include the

conversion of fixed-rate liabilities to variable rates. The derivative financial instruments associated with

these objectives are designated and accounted for as fair value hedges.

As part of managing the exposure to changes in foreign currency exchange rates, the Company

utilizes forward and option contracts with financial institutions acting as principal counterparties. The

objective of these derivative contracts is to minimize impacts to cash flows associated with

intercompany loans, notes receivable and accounts payable, and forecasted transactions due to changes

in foreign currency exchange rates.

The Company’s derivative financial instruments present certain market and counterparty risks;

however, concentration of counterparty risk is mitigated as Tyco deals with a variety of major banks

worldwide with long-term Standard & Poor’s and Moody’s credit ratings of A/A2 or higher. In addition,

only conventional derivative financial instruments are utilized, thereby affording optimum clarity as to

the market risk. None of the Company’s derivative financial instruments outstanding at year end would

result in a significant loss to the Company if a counterparty failed to perform according to the terms of

its agreement. At this time, the Company does not require collateral or other security to be furnished

by the counterparties to its derivative financial instruments.

138 2008 Financials