ADT 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

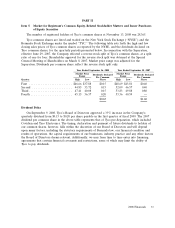

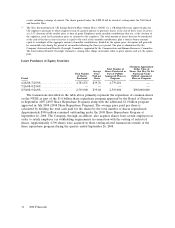

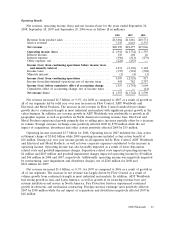

Item 6. Selected Financial Data

The following table sets forth selected consolidated financial data of Tyco. This data is derived

from Tyco’s consolidated financial statements for the five years ended September 26, 2008,

September 28, 2007, September 29, 2006, September 30, 2005 and 2004, respectively. This selected

financial data should be read in conjunction with Tyco’s Consolidated Financial Statements and related

notes included elsewhere in this Annual Report as well as the section of this Annual Report titled

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

2008(1) 2007(2) 2006(3) 2005(4) 2004(5)

(in millions, except per share data)

Consolidated Statements of Operations Data:

Net revenue ............................ $20,199 $18,477 $17,066 $16,385 $15,770

Income (loss) from continuing operations ....... 1,095 (2,524) 817 573 334

Net income (loss) ...................... 1,553 (1,742) 3,590 3,094 2,822

Basic earnings per share:

Income (loss) from continuing operations ....... 2.26 (5.10) 1.63 1.14 0.67

Net income (loss) ...................... 3.21 (3.52) 7.14 6.15 5.64

Diluted earnings per share:

Income (loss) from continuing operations ....... 2.25 (5.10) 1.59 1.11 0.66

Net income (loss) ...................... 3.19 (3.52) 6.95 5.85 5.60

Cash dividends per share(6) ................... 0.65 1.60 1.60 1.25 0.20

Consolidated Balance Sheets Data (End of

Period)(7):

Total assets ............................. $28,804 $32,815 $63,011 $62,465 $63,718

Long-term debt .......................... 3,709 4,082 8,858 10,077 13,917

Shareholders’ equity ...................... 15,494 15,624 35,387 32,619 30,399

(1) Income from continuing operations for the year ended September 26, 2008 includes a class action settlement credit, net of

$10 million, a $9 million goodwill impairment charge, $4 million of separation costs, restructuring, asset impairment and

divestiture charges, net of $248 million, $42 million of incremental stock option charges required under Statement of

Financial Accounting Standards (‘‘SFAS’’) No. 123R, ‘‘Share-Based Payment,’’ and a $258 million loss on extinguishment of

debt related to the consent solicitation and exchange offers and termination of the bridge loan facility. Net income also

includes $458 million of income, net of income taxes, from discontinued operations.

(2) Loss from continuing operations for the year ended September 28, 2007 includes a class action settlement charge, net of

$2.862 billion, $105 million of separation costs, a $46 million goodwill impairment charge related to the reorganization to a

new management and segment reporting structure, restructuring, asset impairment and divestiture charges, net of

$210 million, $120 million of incremental stock option charges required under Statement of Financial Accounting Standards

(‘‘SFAS’’) No. 123R, ‘‘Share-Based Payment,’’ a $259 million loss related to the early retirement of debt and $95 million of

tax charges related to the Separation primarily for the write-off of deferred tax assets that will no longer be realizable. Net

loss also includes $782 million of income, net of income taxes, from discontinued operations.

(3) Income from continuing operations for the year ended September 29, 2006 includes a charge of $100 million related to the

Voluntary Replacement Program, which is included in cost of sales. Also included are $49 million of separation costs,

restructuring, asset impairment and divestiture charges, net of $15 million, $84 million of incremental stock option charges

required under SFAS No. 123R, $72 million of income related to a settlement with a former executive and $48 million of

income resulting from a reduction in our estimated workers’ compensation liabilities primarily due to favorable claims

experience. Net income includes $2,787 million of income, net of income taxes, from discontinued operations as well as a

$14 million loss, net of income taxes, related to the cumulative effect adjustment recorded in conjunction with the adoption

of Financial Accounting Standards Board (‘‘FASB’’) Interpretation (‘‘FIN’’) No. 47, ‘‘Accounting for Conditional Asset

Retirement Obligations—an Interpretation of FASB Statement No. 143’’.

(4) Income from continuing operations for the year ended September 30, 2005 includes restructuring, asset impairment and

divestiture charges, net of $41 million, a $70 million charge related to certain former executives’ employment, a $50 million

charge related to an SEC enforcement action, a loss of $405 million related to the retirement of debt as well as $109 million

of income related to a court-ordered restitution award. Net income also includes $2,500 million of income, net of income

2008 Financials 37