ADT 2008 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

13. Debt (Continued)

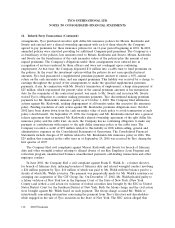

The aggregate amounts of principal debt, including capital leases, maturing during the next five

years and thereafter are as follows (in millions): $671 in 2009, $22 in 2010, $539 in 2011, $1,139 in

2012, $7 in 2013 and $1,874 thereafter.

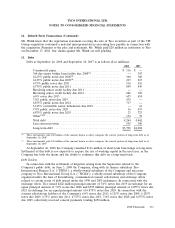

Included in the amount of debt maturing in 2009 is $116 million of commercial paper borrowings

that the Company classified as long-term at September 26, 2008. This debt matures in 2009, but has

been classified as long-term on the Consolidated Balance Sheet as settlement of this debt is not

expected to require the use of working capital in the next year and as the Company has both the intent

and the ability to refinance this debt on a long-term basis.

The weighted-average interest rate on total debt was 6.2% and 6.3% at September 26, 2008 and

September 28, 2007, respectively, excluding the impact of interest rate swaps. The weighted-average

interest rate on short-term debt was 6.1% and 5.5% at September 26, 2008 and September 28, 2007,

respectively. The impact of the Company’s interest rate swap agreements on reported interest expense

was not material for 2008 and 2007, and a net increase of $10 million for 2006. Of this amount,

$6 million of the increase was allocated and included in discontinued operations.

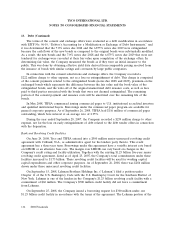

14. Guarantees

Certain of the Company’s business segments have guaranteed the performance of third-parties and

provided financial guarantees for uncompleted work and financial commitments. The terms of these

guarantees vary with end dates ranging from 2008 through the completion of such transactions. The

guarantees would be triggered in the event of nonperformance and the potential exposure for

nonperformance under the guarantees would not have a material effect on the Company’s financial

position, results of operations or cash flows.

There are certain guarantees or indemnifications extended among Tyco, Covidien and Tyco

Electronics in accordance with the terms of the Separation and Distribution Agreement and the Tax

Sharing Agreement. The guarantees primarily relate to certain contingent tax liabilities included in the

Tax Sharing Agreement. See Note 6 for further discussion of the Tax Sharing Agreement. At the time

of the Separation, Tyco recorded a liability necessary to recognize the fair value of such guarantees and

indemnifications in accordance with Financial Accounting Standards Board (‘‘FASB’’) Interpretation

(‘‘FIN’’) No. 45, ‘‘Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect

Guarantees of Indebtedness of Others.’’ In the absence of observable transactions for identical or similar

guarantees, the Company determined the fair value of these guarantees and indemnifications utilizing

expected present value measurement techniques. Significant assumptions utilized to determine fair

value included determining a range of potential outcomes, assigning a probability weighting to each

potential outcome and estimating the anticipated timing of resolution. The probability weighted

outcomes were discounted using the Company’s incremental borrowing rate. The liability necessary to

reflect the fair value of the guarantees and indemnifications under the Tax Sharing Agreement is

$554 million and $543 million, which is included in other liabilities on our Consolidated Balance Sheet

at September 26, 2008 and September 28, 2007, respectively. The guarantees primarily relate to certain

contingent tax liabilities included in the Tax Sharing Agreement. See Note 16 for further discussion of

the Tax Sharing Agreement.

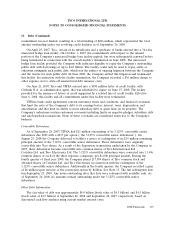

In addition, Tyco historically provided support in the form of financial and/or performance

guarantees to various Covidien and Tyco Electronics operating entities. In connection with the

Separation, the Company worked with the guarantee counterparties to cancel or assign these

guarantees to Covidien or Tyco Electronics. To the extent these guarantees were not assigned prior to

136 2008 Financials