ADT 2008 Annual Report Download - page 73

Download and view the complete annual report

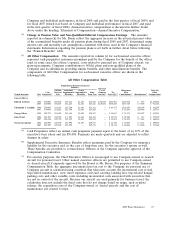

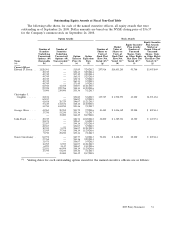

Please find page 73 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Plan (for other triggering events). Under the CIC Severance Plan (both pre- and post-

amendment), each of Messrs. Coughlin and Evard would be entitled to a severance payment of

2.99 times his base salary and 2.99 times his target bonus for the fiscal year in which termination

occurs, and Messrs. Gursahaney and Oliver would be entitled to 2 times his base salary and target

bonus. Under the Severance Plan, each named executive officer (except Mr. Breen) would have

been entitled to salary continuation and bonus payments for the 24 months following termination

of employment. In addition to the amounts included in this table, each named executive officer

(including Mr. Breen) may be entitled to a prorated portion of the Annual Performance Bonus for

the year in which his employment was terminated. The bonus payments are included in the

Summary Compensation table under the column heading ‘‘Non-Equity Incentive Compensation,’’

and are discussed above under the heading ‘‘Elements of Compensation—Annual Incentive

Compensation.’’

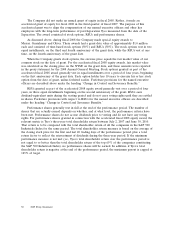

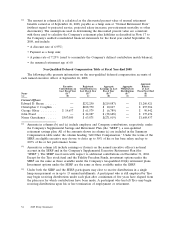

(2) Upon a triggering event, Mr. Breen’s pre-amended employment agreement provides for

continuation of health and welfare benefits (or a cash equivalent) for 36 months following the

termination date provided he continues to pay the employee portion of such programs. Under

Mr. Breen’s amended employment agreement, Mr. Breen is entitled to continued participation in

health and welfare plans over the same time period for which severance is payable, subject to an

18-month limit on medical benefits. If continued participation is not practicable, and/or if

Mr. Breen’s severance period is greater than 18 months, an equivalent cash payment is made, with

a tax gross-up on such amounts. For each of the other named executive officers, medical and

dental benefits are provided under the CIC Severance Plan or the Severance Plan. As of

September 26, 2008, under the CIC Severance Plan, each executive was entitled to 12 months of

outplacement services and continuation of medical and dental benefits (or a cash equivalent) for

36 months (24 months for Mr. Gursahaney and Mr. Oliver). Under the Severance Plan, the time

period was 24 months. Effective January 1, 2009, these plans were amended to shorten the time

period for which the executives are entitled to employer-sponsored health and dental benefits

under these plans. Under both plans, the period is now limited to the lesser of the executive’s

remaining severance period and 12 months; if the executive’s severance period is greater than

12 months, the executive will be entitled to a cash payment equal to the projected value of the

employer portion of premiums during the severance period in excess of 12 months.

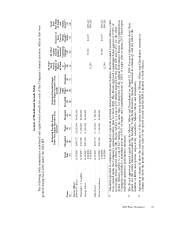

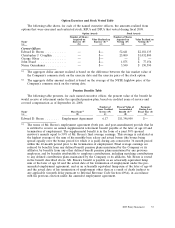

(3) Amounts represent the intrinsic value of all unvested Tyco equity awards and stock options that

would vest upon a triggering event. For Mr. Breen, the amounts in columns (b), (c) and

(e) include a tax gross-up payment to the State of New York of $42,915, and the amount in

column (g) includes such a payment of $34,760. In addition to the amounts shown in the table,

Messrs. Breen, Coughlin and Evard each hold equity of Tyco Electronics and Covidien, the vesting

of which would have been accelerated from November 22, 2008 upon the occurrence of a

triggering event. The cost to the Company of such acceleration would have been immaterial.

(4) Under Mr. Breen’s pre-amended employment agreement, in circumstances outside of a change in

control, if Mr. Breen voluntarily terminated employment before age 60 without Good Reason,

benefits deemed earned under his pension plan (the Supplemental Executive Retirement Plan)

would have been subject to a reduction of 0.25% for each month or partial month that the

termination date preceded age 60, and an additional 0.25% for each month or partial month that

he elected to commence payment of the benefit prior to age 60. Under Mr. Breen’s amended

employment agreement, if Mr. Breen voluntarily terminates employment without Good Reason, or

his employment is terminated for Cause prior to age 60, benefits deemed earned under the

Supplemental Executive Retirement Plan will be subject to a reduction of 0.25% for each month

or partial month the termination date is prior to age 60. The amount shown in column (b) does

not reflect any reduction in benefits related to an election to receive payments earlier than age 60.

For Mr. Breen, the amounts in column (b) and (c) include a tax gross up payment to the State of

New York of $33,954, and the amount in column (e) includes such a payment of $7,916.

(5) In the event of a change in control, Mr. Breen’s employment agreement provides for a full

gross-up of any federal excise tax that might be due under Section 4999 of the Internal Revenue

Code, including any such tax on the value of any acceleration of unvested equity of Tyco

Electronics and Covidien. No other named executive is eligible for this benefit.

56 2009 Proxy Statement