ADT 2008 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

12. Related Party Transactions (Continued)

Mr. Walsh knew that the registration statement covering the sale of Tyco securities as part of the CIT

Group acquisition contained a material misrepresentation concerning fees payable in connection with

the acquisition. Pursuant to the plea and settlement, Mr. Walsh paid $20 million in restitution to Tyco

on December 17, 2002. Our claims against Mr. Walsh are still pending.

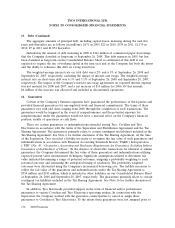

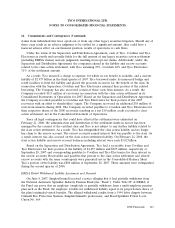

13. Debt

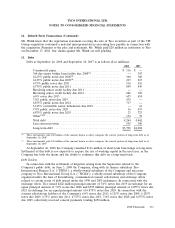

Debt at September 26, 2008 and September 28, 2007 is as follows ($ in millions):

2008 2007

Commercial paper .................................... $ 116 $ —

364-day senior bridge loan facility due 2008(2) ................ — 367

6.125% public notes due 2008(1) .......................... 300 300

6.125% public notes due 2009(1) .......................... 215 215

6.75% public notes due 2011 ............................ 516 516

6.375% public notes due 2011 ........................... 849 849

Revolving senior credit facility due 2011 .................... — —

Revolving senior credit facility due 2012 .................... 286 308

6.0% notes due 2013 .................................. 655 654

7.0% public notes due 2019 ............................. 435 —

6.875% public notes due 2021 ........................... 717 —

3.125% convertible senior debentures due 2023 ............... — 21

7.0% public notes due 2028 ............................. 16 437

6.875% public notes due 2029 ........................... 23 723

Other(1)(2) .......................................... 136 72

Total debt .......................................... 4,264 4,462

Less current portion .................................. 555 380

Long-term debt ...................................... $3,709 $4,082

(1) These instruments, plus $40 million of the amount shown as other, comprise the current portion of long-term debt as of

September 26, 2008.

(2) These instruments, plus $13 million of the amount shown as other, comprise the current portion of long-term debt as of

September 28, 2007.

At September 26, 2008 the Company classified $116 million of short-term borrowings as long-term.

Settlement of this debt is not expected to require the use of working capital in the next year, as the

Company has both the intent and the ability to refinance this debt on a long-term basis.

Debt Tenders

In connection with the settlement of litigation arising from the Separation related to the

Company’s public debt, on June 3, 2008 the Company, along with its finance subsidiary Tyco

International Finance S.A. (‘‘TIFSA’’), a wholly-owned subsidiary of the Company and successor

company to Tyco International Group S.A. (‘‘TIGSA’’), a wholly-owned subsidiary of the Company

organized under the laws of Luxembourg, consummated consent solicitations and exchange offers

related to certain series of debt issued under the 1998 and 2003 indentures. In connection with the

exchange offers, Tyco issued $422 million principal amount of 7.0% notes due 2019 in exchange for an

equal principal amount of 7.0% notes due 2028 and $707 million principal amount of 6.875% notes due

2021 in exchange for an equal principal amount of 6.875% notes due 2029. In connection with the

consent solicitations, holders of the Company’s 6.0% notes due 2013, 6.125% notes due 2008, 6.125%

notes due 2009, 6.75% notes due 2011, 6.375% notes due 2011, 7.0% notes due 2028 and 6.875% notes

due 2029 collectively received consent payments totaling $250 million.

2008 Financials 133