ADT 2008 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

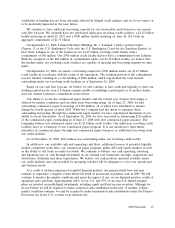

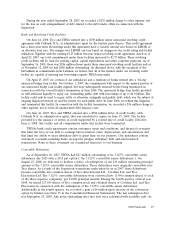

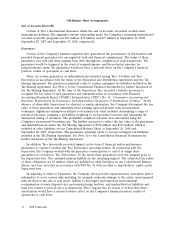

The sources of our cash flow from operating activities and the use of a portion of that cash in our

operations for the years ended September 26, 2008, September 28, 2007 and September 29, 2006 were

as follows ($ in millions):

2008 2007 2006

Cash flows from operating activities:

Operating income (loss) ........................ $1,941 $(1,732) $1,355

Goodwill impairment .......................... 9 46 —

Non-cash restructuring and asset impairment charges,

net ..................................... 37 24 2

Losses on divestitures .......................... — 4 2

Depreciation and amortization(1) .................. 1,154 1,148 1,180

Non-cash compensation expense .................. 99 173 151

Deferred income taxes ......................... (94) (16) (413)

Provision for losses on accounts receivable and inventory . . 135 94 55

Loss on the retirement of debt ................... 258 259 1

Other, net .................................. (124) (231) (37)

Class action settlement liability ................... (3,020) 2,992 —

Net change in working capital .................... (646) (414) 223

Interest income .............................. 110 104 46

Interest expense .............................. (396) (313) (279)

Income tax expense ........................... (335) (324) (304)

Net cash (used in) provided by operating activities ..... $ (872) $ 1,814 $1,982

Other cash flow items:

Capital expenditures, net(2) ...................... $ (706) $ (643) $ (517)

Decrease in sale of accounts receivable ............. 14 7 8

Acquisition of customer accounts (ADT dealer program) . . (376) (409) (373)

Purchase accounting and holdback liabilities ......... (2) (10) (7)

Voluntary pension contributions .................. 4 23 —

(1) Includes depreciation expense of $626 million, $635 million and $663 million in 2008, 2007 and 2006, respectively, and

amortization of intangible assets of $528 million, $513 million and $517 million in 2008, 2007 and 2006, respectively.

(2) Includes net proceeds of $28 million, $23 million and $39 million received for the sale/disposition of property, plant and

equipment in 2008, 2007 and 2006, respectively.

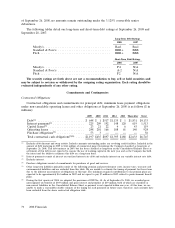

The net change in working capital decreased operating cash flow by $646 million in 2008. The

components of this change are set forth in detail in the Consolidated Statements of Cash Flows. The

significant changes in working capital included a $176 million increase in accounts receivable, a

$138 million increase in inventories, and a $152 million decrease in accrued and other liabilities,

primarily due to accrued warranties.

During the second quarter of 2008, Tyco released $2,960 million of funds placed in escrow during

the third quarter of 2007 as well as $60 million of interest earned on those funds for the benefit of the

class as stipulated in the Court’s final order related to the class action settlement.

During 2008, we substantially completed the sale of our Infrastructure Services business for net

cash proceeds of $396 million, sold 100% of the stock of ETEO for $338 million in net cash proceeds,

sold Ancon Building Products for $171 million in net cash proceeds, and completed the sale of NDC

for $49 million in net cash proceeds.

We continue to fund capital expenditures to improve the cost structure of our businesses, to invest

in new processes and technology, and to maintain high quality production standards. The level of

capital expenditures in 2009 is expected to exceed spending levels in 2008 of $734 million and is also

expected to exceed depreciation of $626 million.

On July 10, 2008, Tyco’s Board of Directors approved a $1.0 billion share repurchase program

under which we have repurchased 2.5 million common shares for $100 million. We also repurchased

66 2008 Financials