ADT 2008 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2008 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

In June 2008 the FASB ratified FASB Staff Position No. EITF 03-6-1, ‘‘Determining Whether

Instruments Granted in Share-Based Payment Transactions are Participating Securities’’ (FSP No.

EITF 03-6-1), which addresses whether instruments granted in share-based payment awards are

participating securities prior to vesting and, therefore, must be included in the earnings allocation in

calculating earnings per share under the two-class method described in SFAS No. 128, ‘‘Earnings per

Share’’ (SFAS No. 128). FSP No. EITF 03-6-1 requires that unvested share-based payment awards that

contain non-forfeitable rights to dividends or dividend-equivalents be treated as participating securities

in calculating earnings per share. FSP No. EITF 03-6-1 is effective for Tyco in fiscal 2010 and interim

periods within those fiscal years, and shall be applied retrospectively to all prior periods. We are

currently evaluating the effects, if any that FSP No. EITF 03-6-1 may have on earnings per share.

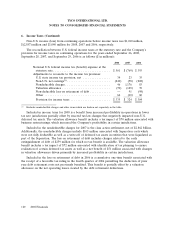

2. Divestitures

Held for Sale and Reflected as Continuing Operations

During the third quarter of 2008, the Company approved a plan to sell a business in the Safety

Products segment. This business is presented in continuing operations as the criteria for discontinued

operations has not been met. The Company has assessed and determined that the carrying value of this

business is recoverable and will continue to assess recoverability based on current fair value, less cost to

sell, until the business is sold. Fair value used for the impairment assessment was based on existing

market conditions. The Company expects to complete a sale during the first half of fiscal 2009.

Discontinued Operations

The Company continued to assess the strategic fit of its various businesses and has pursued

divestiture of certain businesses which do not align with its long-term strategy.

During 2008, as part of the Company’s portfolio refinement efforts, the Company sold its ETEO

business, Ancon business, NDC business, and a European manufacturer of public address products and

acoustic systems. Additionally, the Company substantially completed the sale of its Infrastructure

Services Business, during the fourth quarter of 2008. These businesses met the held for sale and

discontinued operations criteria and have been included in discontinued operations in all periods

presented.

In May 2008, the Company sold 100% of the stock of ETEO, a Brazilian subsidiary of

Infrastructure Services for $338 million of net cash proceeds and recorded a pre-tax gain of

$232 million, including the effects of the economic hedge of the purchase price discussed below. The

gain was recorded in Income (loss) from discontinued operations, net of income taxes in the Company’s

Consolidated Statement of Operations. ETEO was part of the Company’s Corporate and Other

segment. During September 2007, Tyco entered into an economic hedge of the Brazilian Real

denominated contractual sale price of the ETEO business. Since the hedging transaction was directly

linked to the proceeds from the sale of a business that was reflected in discontinued operations, Tyco

began including the impact of the hedge in discontinued operations during the first quarter of 2008.

During the third quarter of 2008, Tyco incurred a pre-tax loss of $36 million on this hedge. The impact

of the hedge in the prior year was not material.

In February 2008, the Company executed a definitive agreement to sell the remaining portion of

Infrastructure Services excluding Earth Tech Brasil Ltda. (‘‘ET Brasil’’) to AECOM Technologies

Corporation (‘‘AECOM’’). In July 2008, the Company substantially completed the sale to AECOM. The

110 2008 Financials