TCF Bank 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 TCF Financial Corporation and Subsidiaries

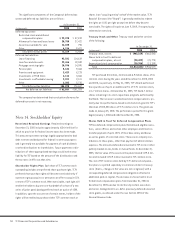

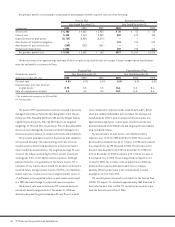

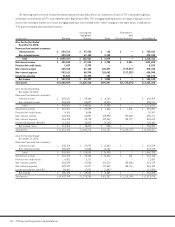

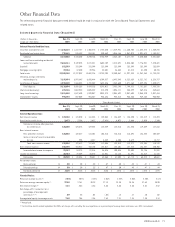

The following table sets forth certain information about the reported profit or loss and assets of each of TCF’s reportable segments,

including a reconciliation of TCF’s consolidated totals. Beginning in 2005, TCF’s mortgage banking business no longer originates or sells

loans to the secondary market. As a result, mortgage banking is now included in the “other” category in the table below, in addition to

TCF’s parent company and corporate functions.

Leasing and Eliminations

Equipment and

(In thousands) Banking Finance Other Reclassifications Consolidated

At or For the Year Ended

December 31, 2005:

Revenues from external customers:

Interest income $ 634,312 $ 97,596 $ 114 $ – $ 732,022

Non-interest income 425,105 47,465 5,760 – 478,330

Total $ 1,059,417 $ 145,061 $ 5,874 $ – $ 1,210,352

Net interest income $ 455,550 $ 57,014 $ 2,780 $ 2,346 $517,690

Provision for credit losses 1,029 3,993 – – 5,022

Non-interest income 425,105 47,465 125,337 (119,577) 478,330

Non-interest expense 553,161 48,596 126,062 (117,231) 610,588

Income tax expense 96,532 18,493 253 – 115,278

Net income $ 229,933 $ 33,397 $ 1,802 $ – $ 265,132

Total assets $12,908,059 $1,635,528 $195,447 $(1,373,674) $13,365,360

At or For the Year Ended

December 31, 2004:

Revenues from external customers:

Interest income $ 529,281 $ 89,364 $ 4,164 $ – $ 622,809

Non-interest income 426,580 50,697 12,934 – 490,211

Total $ 955,861 $ 140,061 $ 17,098 $ – $ 1,113,020

Net interest income $ 427,521 $ 55,699 $ 7,336 $ 1,335 $ 491,891

Provision for credit losses 4,141 6,806 – – 10,947

Non-interest income 426,580 50,697 109,996 (97,062) 490,211

Non-interest expense 516,426 43,718 122,262 (95,727) 586,679

Income tax expense (benefit) 113,628 20,000 (4,145) – 129,483

Net income (loss) $ 219,906 $ 35,872 $ (785) $ – $ 254,993

Total assets $ 11,891,260 $ 1,460,778 $ 212,701 $ (1,224,172) $ 12,340,567

At or For the Year Ended

December 31, 2003:

Revenues from external customers:

Interest income $ 545,764 $ 81,912 $ 13,843 $ – $ 641,519

Non-interest income 355,039 51,088 13,152 – 419,279

Total $ 900,803 $ 133,000 $ 26,995 $ – $ 1,060,798

Net interest income $ 415,202 $ 45,358 $ 20,244 $ 341 $ 481,145

Provision for credit losses 4,361 8,171 – – 12,532

Non-interest income 355,039 51,088 102,210 (89,058) 419,279

Non-interest expense 489,287 41,977 117,562 (88,717) 560,109

Income tax expense (benefit) 96,421 17,031 (1,547) – 111,905

Net income $ 180,172 $ 29,267 $ 6,439 $ – $ 215,878

Total assets $ 10,902,749 $ 1,228,208 $ 301,252 $ (1,113,194) $ 11,319,015