TCF Bank 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

612005 Form 10-K

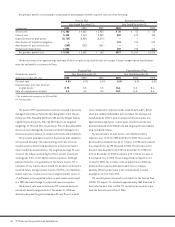

Postretirement Plan TCF provides health care benefits for

eligible retired employees (the “Postretirement Plan”). Effective

January 1, 2000, TCF modified the Postretirement Plan for employ-

ees not yet eligible for benefits under the Postretirement Plan by

eliminating the Company subsidy. The plan provisions for full-time

and retired employees then eligible for these benefits were not

changed. The Postretirement Plan is not funded.

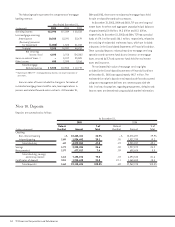

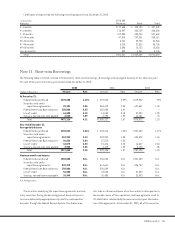

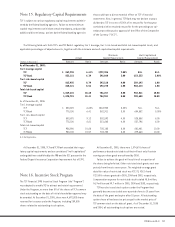

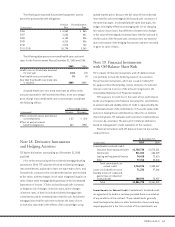

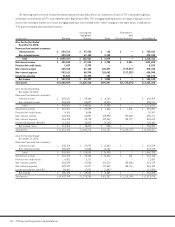

The following table sets forth the status of the Pension Plan and the Postretirement Plan at the dates indicated:

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

(In thousands) 2005 2004 2005 2004

Benefit obligation:

Accrued participant balance – vested $56,436 $47,646 N.A. N.A.

Accrued participant balance – unvested 3,038 5,217 N.A. N.A.

Subtotal 59,474 52,863 N.A. N.A.

Present value of future service and benefits 2,602 2,351 N.A. N.A.

Total projected benefit obligation $62,076 $55,214 N.A. N.A.

Accumulated benefit obligation $55,611 $48,296 N.A. N.A.

Change in benefit obligation:

Benefit obligation at beginning of year $55,214 $50,830 $ 9,675 $12,386

Service cost – benefits earned during the year 5,303 4,632 35 53

Interest cost on projected benefit obligation 3,428 3,164 552 672

Plan amendments – (451) (207) (629)

Actuarial loss (gain) 1,678 258 (249) (1,793)

Benefits paid (3,547) (3,219) (1,150) (1,014)

Projected benefit obligation at end of year 62,076 55,214 8,656 9,675

Change in fair value of plan assets:

Fair value of plan assets at beginning of year 58,561 53,855 ––

Actual return on plan assets 6,936 5,350 ––

Benefits paid (3,547) (3,219) (1,150) (1,014)

TCF contributions – 2,575 1,150 1,014

Fair value of plan assets at end of year 61,950 58,561 ––

Funded status of plans:

Funded status at end of year (126) 3,347 (8,656) (9,675)

Unamortized transition obligation – – 706 1,044

Unamortized prior service cost (421) (670) ––

Unrecognized net loss 23,626 24,207 2,344 2,732

Prepaid (accrued) benefit cost at end of year $23,079 $26,884 $(5,606) $(5,899)

N.A. Not Applicable.

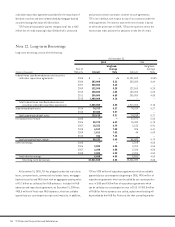

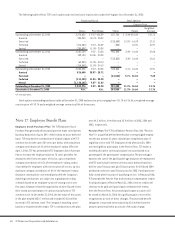

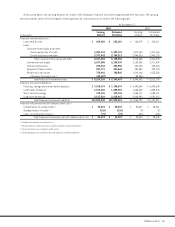

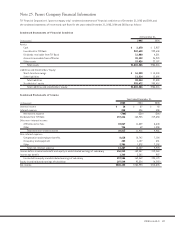

The measurement date used for determining the Pension Plan and the Postretirement Plan projected and accumulated benefit obliga-

tions above and the date used to value plan assets disclosed above was September 30, 2005 and 2004. The discount rate and rate of

increase in future compensation used to measure the benefit obligation were as follows:

Pension Plan Postretirement Plan

Assumptions used to At December 31, At December 31,

determine benefit obligations 2005 2004 2003 2005 2004 2003

Discount rate 5.25% 6.0% 6.0% 5.25% 6.0% 6.0%

Rate of compensation increase 4.0 4.0 4.5 N.A. N.A. N.A.

N.A. Not Applicable.