TCF Bank 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 TCF Financial Corporation and Subsidiaries

Contractual Obligations and Commitments As disclosed in the Notes to Consolidated Financial Statements, TCF has certain obliga-

tions and commitments to make future payments under contracts. At December 31, 2005, the aggregate contractual obligations (excluding

bank deposits) and commitments are as follows:

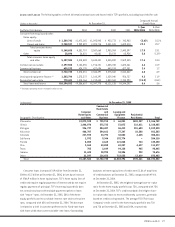

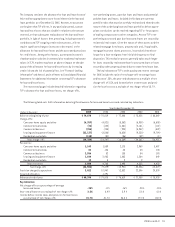

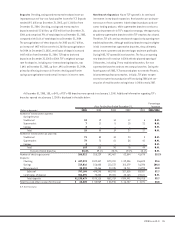

(In thousands) Payments Due by Period

Less than 1-3 4-5 After 5

Contractual Obligations Total 1 Year Years Years Years

Total borrowings $2,983,136 $805,519 $229,292 $224,647 $1,723,678

Annual rental commitments under non-cancelable

operating leases 187,704 26,891 42,889 34,187 83,737

Campus marketing agreements 51,068 1,623 2,770 5,103 41,572

Construction contracts and land purchase commitments

for future branch sites 13,996 13,996–––

$3,235,904 $848,029 $274,951 $263,937 $1,848,987

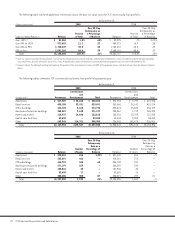

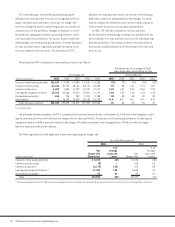

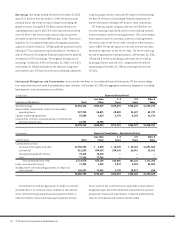

(In thousands) Amount of Commitment – Expiration by Period

Less than 1-3 4-5 After 5

Commitments Total 1 Year Years Years Years

Commitments to lend:

Consumer home equity and other $1,750,738 $ 8,470 $ 15,239 $ 35,165 $1,691,864

Commercial 811,652 494,514 230,646 66,961 19,531

Leasing and equipment finance 74,418 74,418–––

Other 77,766 77,766 – – –

Total commitments to lend 2,714,574 655,168 245,885 102,126 1,711,395

Loans serviced with recourse 71,332 1,548 3,237 2,963 63,584

Standby letters of credit and guarantees on industrial

revenue bonds 100,892 76,436 5,735 18,071 650

$2,886,798 $733,152 $254,857 $123,160 $1,775,629

Commitments to lend are agreements to lend to a customer

provided there is no violation of any condition in the contract.

These commitments generally have fixed expiration dates or

other termination clauses and may require payment of a fee.

Since certain of the commitments are expected to expire without

being drawn upon, the total commitment amounts do not necessar-

ily represent future cash requirements. Collateral predominantly

consists of residential and commercial real estate.

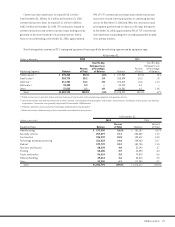

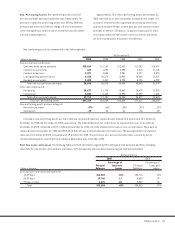

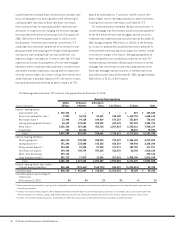

Borrowings Borrowings totaled $3 billion at December 31, 2005,

down $121.5 million from December 31, 2004. The decrease was

primarily due to the overall increase in deposits exceeding the

growth in assets. During 2005, TCF Bank issued $50 million of

subordinated notes due in 2015. The notes bear interest at a fixed

rate of 5.00% for the first five years and will reprice quarterly

thereafter at the three-month LIBOR rate plus 1.56%. These notes

qualify as Tier 2 or supplemental capital for regulatory purposes,

subject to certain limitations. TCF Bank paid the proceeds from the

offering to TCF as a permanent capital distribution. See Notes 11

and 12 of Notes to Consolidated Financial Statements for detailed

information on TCF’s borrowings. The weighted-average rate on

borrowings increased to 4.49% at December 31, 2005, from 3.37%

at December 31, 2004 primarily due to the impact of rising short-

term interest rates. TCF does not utilize unconsolidated subsidiaries

or special purpose entities to provide off-balance sheet borrowings.

See Note 19 of Notes to Consolidated Financial Statements for

further information relating to off-balance sheet instruments.

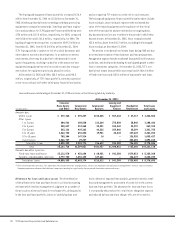

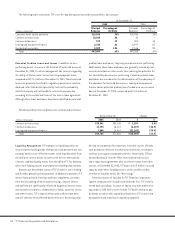

TCF Financial (parent company only) has a $105 million line

of credit maturing in April 2006, which is unsecured and contains

certain covenants common to such agreements. TCF is not in default

with respect to any of its covenants under the credit agreement.

The interest rate on the line of credit is based on either the prime

rate or LIBOR. TCF has the option to select the interest rate index

and term for advances on the line of credit. The line of credit may

be used for appropriate corporate purposes. At December 31, 2005,

TCF had $16.5 million outstanding on this bank line of credit at

an average interest rate of 5.15%, compared with $14 million

outstanding at December 31, 2004 at an average interest rate

of 3.18%.