TCF Bank 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

212005 Form 10-K

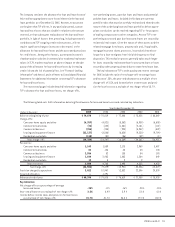

fixed-rate loans and lower-cost deposits to higher-cost deposits.

If interest rates increase, TCF’s net interest income is likely to

increase, but could be partially offset by an adverse impact on

deposit account balances and rates, as competition for checking,

savings and money market deposits, important sources of lower-

cost funds for TCF, is intense. See “Consolidated Financial

Condition Analysis – Deposits” and “Quantitative and Qualitative

Disclosures about Market Risk” for further discussion on TCF’s

interest-rate risk position.

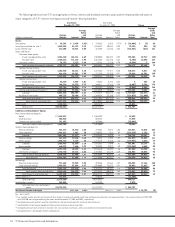

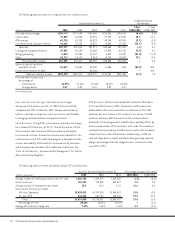

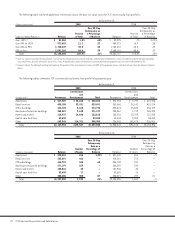

Net interest income was $517.7 million for 2005, up 5.2% from

$491.9 million in 2004. The increase in 2005 in net interest income

primarily reflects the growth in average consumer, commercial

and leasing and equipment finance balances, up $1.1 billion over

2004, partially offset by higher funding costs. The decrease in

the net interest margin, from 4.54% in 2004 to 4.46% in 2005, is

primarily due to the rates on interest-bearing liabilities increasing

more than the yields on interest-earning assets, as a result of

increased deposits with higher rates and increased fixed-rate

consumer loans with yields lower than variable-rate loans. TCF’s

benefit from the rising short-term interest rates, and the related

increase in yields on variable-rate loans, has been more than off-

set by the impact of a flattening yield curve making fixed-rate

loans more attractive to customers and changes in the funding

mix as the majority of deposit growth has been in higher interest

cost products.

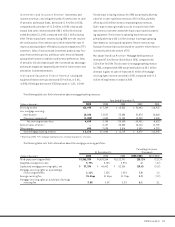

Net interest income was $491.9 million in 2004, up from

$481.1 million in 2003. The increase in 2004 from 2003 in net

interest income primarily reflects the growth in average consumer,

commercial and leasing and equipment finance balances, up $1

billion over 2003, partially offset by the reductions in residential

real estate loans and mortgage-backed securities, down $690.3

million from 2003, and residential mortgage loans held for sale,

down $179.9 million during the same period. The decrease in

average residential real estate loans and mortgage-backed

securities reflected management’s decision to delay investing in

long-term fixed-rate residential real estate loans and mortgage-

backed securities to replace prepayments and sales of such

assets during the very low interest rate environment coupled with

the growth in higher yielding consumer, commercial and lease

equipment finance loans and leases.

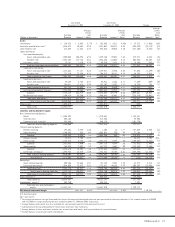

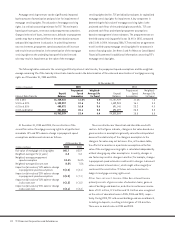

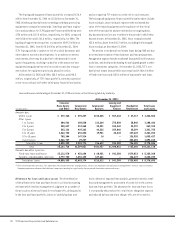

Provision for Credit Losses TCF provided $5 million for credit

losses in 2005, compared with $10.9 million in 2004 and $12.5

million in 2003. The decrease in the provision from 2004 was

primarily due to improved credit quality, including a $3.3 million

commercial business loan recovery in 2005. Net loan and lease

charge-offs were $24.5 million, or .25% of average loans and

leases in 2005, up from $9.5 million, or .11% of average loans and

leases in 2004 and $12.9 million, or .16% of average loans and

leases in 2003. Delta declared bankruptcy on September 14,2005,

and TCF charged off its $18.8 million investment in the related

leveraged lease. Net loan and lease charge-offs excluding the

charge-off related to the leveraged lease were $5.7 million, or

.06% of average loans and leases in 2005.

The provision for credit losses is calculated as part of the

determination of the allowance for loan and lease losses. The

determination of the allowance for loan and lease losses and

the related provision for credit losses is a critical accounting

estimate which involves a number of factors such as historical

trends in net charge-offs, delinquencies in the loan and lease

portfolio, value of collateral, general economic conditions and

management’s assessment of credit risk in the current loan and

lease portfolio. Also see “Consolidated Financial Condition

Analysis – Allowance for Loan and Lease Losses.”

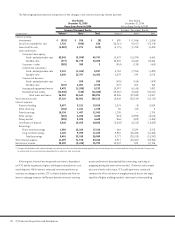

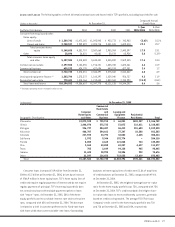

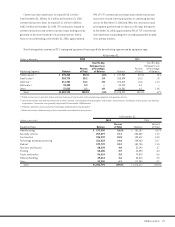

Non-Interest Income Non-interest income is a significant

source of revenue for TCF, representing 48% of total revenues

in 2005, and is an important factor in TCF’s results of operations.

Providing a wide range of retail banking services is an integral

component of TCF’s business philosophy and a major strategy for

generating additional non-interest income. Total non-interest

income was $478.3 million for 2005, compared with $490.2 million

in 2004 and $419.3 million in 2003. The number of checking

accounts totaled 1,603,173 accounts at December 31, 2005, up

4.4% from 1,535,152 accounts at December 31, 2004 which were

up 6.3% from 1,443,821 accounts at December 31, 2003.